Discounted Debts: Behind the Flow – Chapter 1

Cases covered in this chapter: A69, A98, A97, A65

Indemo’s mission is to bring discounted debts to private investors as a new asset class. And when you introduce something new, it’s not enough to simply offer the product — you must also educate, guide, and provide context for how it works in real life.

An essential part of that mission is staying close to our investor community. We read and act on your feedback — including critical comments — because it helps us sharpen the product, focus on what truly matters, and set the right development priorities.

One of the most consistent requests we hear is for more transparency on special cases — especially when real progress isn’t clearly visible in the Recovery Flow, or when work is happening through alternative exit scenarios like out-of-court settlements or a sale on the institutional secondary market.

That request makes complete sense — because discounted debt investing is not only about what changes on the screen. It’s also about the work happening behind the scenes, and how that work influences the value and pricing of your portfolio. At the same time, it doesn’t always make sense to surface every “institutional-style” pricing and tradability detail directly in the interface until the Secondary Market is live — which is exactly why we’re explaining it in this series in a clear, investor-friendly way.

Today we’re launching a regular blog series, “Discounted Debts: Behind the Flow”. Think of it as placing our community in the seat of a professional debt market participant — the buyer — and sharing the type of structured case updates that legal recovery teams provide in the institutional market. We’re doing this to further educate and prepare you for the upcoming Secondary Market on Indemo, so you feel confident navigating how cases are priced, traded, and managed in real market conditions.

In this chapter you’ll find:

- Why “Behind the Flow” — what investors don’t see in the Recovery Flow (and why it matters)

- How institutional buyers price mortgage NPLs — timing risk, PTV/PTD boundaries, and the built-in buffer

- Why appeal/opposition stages are a turning point — what changes in exit probability and pricing

- Case studies: A69 (Valencia), A98 (Valencia, A65 (Madrid), A97 (Madrid)

- Bottom line + CEO note — what this means for liquidity, the Secondary Market, and investor strategies

How the legal process is linked to the value of the debt as an asset

Indemo’s key task is to translate how the institutional and professional debt market works — where the “big sharks” operate — into an accessible product for ordinary private investors, making the product more liquid and tradable.

That is also why we are building the Secondary Market in 2026: to reflect the same fundamental rules and pricing logic used in the institutional NPL market.

Because Indemo is a strictly regulated MiFID investment firm, building this market is not only a product decision — it also depends on a variety of external factors and stakeholders. Over the past year, we worked through a complex legal-structuring process and negotiations with the regulator that took around 15 months, which culminated in the long-anticipated release of “1 Note = 1 Debt instrument” in November 2025. This change laid the necessary foundation for an Indemo Secondary Market — a concept that was not feasible under the earlier instrument structure of basket Notes (exposure to up to 8 debts).

At the same time, we’re already actively working on the Secondary Market project. As part of that work, we plan to embed into the market logic the same “behind the flow” parameters and case-level signals we discuss in this series — the factors that institutional buyers look at when pricing and trading NPLs, and which will become increasingly relevant once investors can buy and sell Notes directly on Indemo.

The core risk in mortgage NPL investing: timing, not enforceability

In the institutional mortgage NPL market of Spain, risk is not about whether foreclosure is possible. Mortgage loans are a foundation of the national banking system and are safeguarded by strict legislation and established court practice. In addition, mortgage NPLs are always backed by a real residential collateral asset — a property that doesn’t simply “disappear,” which is exactly why enforceability is typically not the core question.

The key variable that drives outcomes is timing — how long the case takes to resolve, and how that timeline affects the expected return.

The model used to list Notes — and to support liquidity

When our servicing partner acquires debts and lists them on Indemo, each Note follows a strict performance model. This is the same type of model institutional buyers and sellers rely on — and it will also be used by Indemo AutoInvest strategies in the upcoming Secondary Market, helping provide liquidity and support consistent market activity.

The model is built around three core principles:

- Target return

- Time to exit

- Recovery stage-based pricing boundaries (PTV/PTD limits for each Flow stage)

It is designed to keep the target return achievable even under conservative (“worse timing”) recovery scenarios — including a very slow full recovery cycle of up to 5 years, assuming no alternative exit scenarios are available — and it explicitly includes in its assumptions the most lengthy and less predictable stages, such as appeal and subrogation.

It’s also important to remember that the model includes a built-in discount buffer — roughly ~7.5%–8% per year in PTV/PTD terms (driven by the relationship between real estate value and the growing debt amount) — which helps absorb longer recovery timelines while still supporting the product’s target return.

This logic has been embedded into Indemo from the very beginning to ensure that assets remain liquid and tradable — whether on Indemo’s future Secondary Market or on the broader institutional market — as already demonstrated by completed repayment cases on Indemo.

Why appeal and opposition stages matter so much

The “worse timing” scenario explicitly includes stages like appeal and subrogation. These can be lengthy, and they can appear at different points of the Recovery Flow.

A key point for any professional debt buyer (including future Indemo AutoInvest strategy) is that once a case passes a major appeal/opposition stage, the time to exit often decreases significantly, and the asset value increases materially.

This is one of the reasons why the servicing company typically does not place cases for sale on the market before the appeal stage is successfully resolved — in line with Indemo’s product strategy: maximizing possible profit within the shortest realistic timeframe.

If the Indemo strategy were only to target the absolute shortest timeline at any cost, the return profile would naturally be weaker.

Why passing the appeal stage is great news for investors

In this first episode, we’ll look into several case studies — discounted debts A98, A69, A97, and A65 — that have been impacted by lengthy appeal / opposition stages, and how those stages correlate with pricing and value development over time.

We’ll also explain why passing a major appeal stage is often good news for investors who entered earlier: it can meaningfully improve the asset’s risk profile, shorten the remaining expected timeline, and increase its market value and profit potential — exactly the kind of shift that professional buyers look for when pricing debt in the institutional market.

Another important positive factor is that, in practice, a debtor typically has just one major appeal opportunity in this context. Once that appeal is filed and successfully resolved in favour of the creditor, it often clears the path toward execution and exit, reducing uncertainty and supporting a material price boost for the asset.

Behind the Flow: what’s been achieved

In the sections below, we’ll break down what has been achieved behind the scenes in each case — what actions were taken, why they were necessary, and how they increase asset value and support the next steps toward the most effective exit scenario.

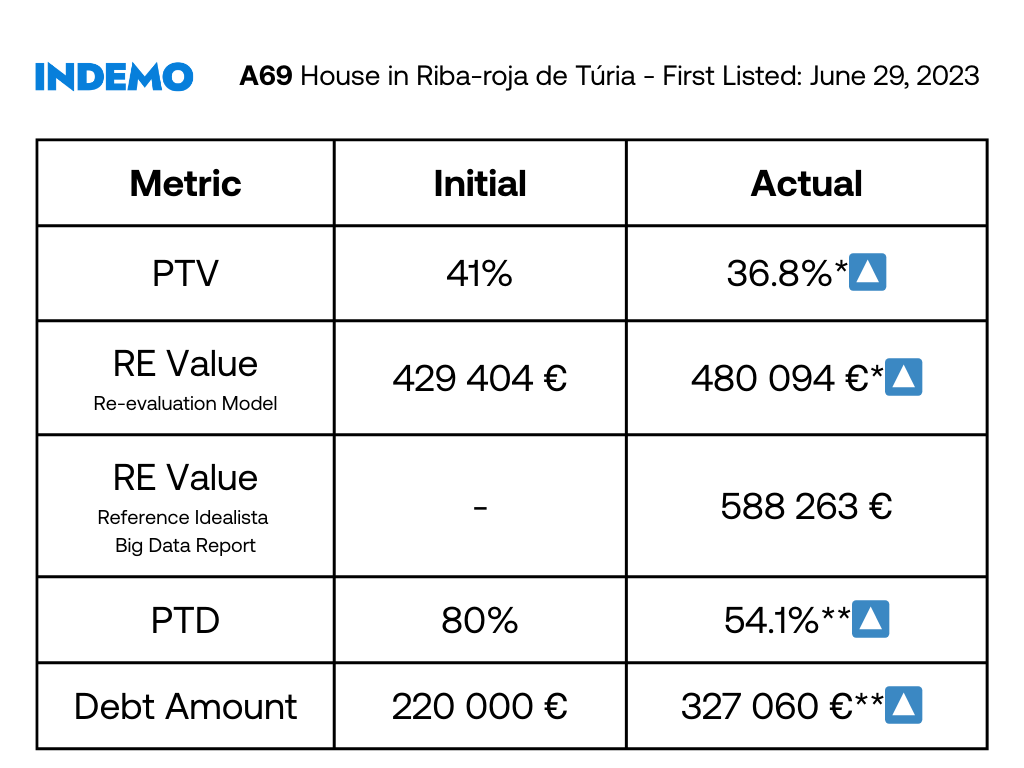

A69 House in Riba-roja de Túria

Valencia - Current Flow Stage: Appeal (Step 9) (since Mar 31, 2025)

Key achievements

On the platform, the case appears in the Appeal stage. Under the hood, the appeal triggered a tactical decision by the legal firm to pause the standard foreclosure sequence and run an additional proceeding designed to (1) strengthen Tamarindo’s legal position and (2) accelerate the next steps while minimizing risks later in enforcement.

This is not a standard situation — it’s an exceptional case driven by the debtor taking an active, disruptive approach, including filing appeals. That’s why the legal team implemented extra measures to protect investors’ interests and preserve recovery efficiency.

After the debtor filed an appeal within the main foreclosure process, the legal team prioritized securing a clean and robust judicial title that:

- Confirms servicing company’s position as creditor (removing room for procedural objections), and

- Crystallizes the payable amount (principal + enforceable interest framework)

This reduces uncertainty, strengthens enforceability, and prevents the debtor from using technical arguments to slow down later stages. In practice, once a debtor loses the appeal, they often become more flexible in out-of-court negotiations, because their procedural leverage is significantly reduced.

The court ruled in servicing company’s favor in October 2025. The judgment delivers three key outcomes:

- Contract resolution confirmed

The mortgage loan contract is formally declared resolved due to the borrower’s breach, and the judgment records the full assignment chain (showing how the claim was transferred and confirming servicing company’s standing). - Monetary condemnation

The debtors are ordered to pay the confirmed amount plus post-judgment interest until full payment. This increases pressure on the debtor and improves recovery economics over time. - No adverse costs

The court did not impose procedural costs on servicing company (“no condena en costas”), which is a positive outcome from a cost-risk perspective.

The legal team is now waiting for the judgment to become final (“firme”). This is the standard gateway to starting enforcement with maximum procedural strength.

Once the judgment is final, servicing company can proceed immediately to execution/enforcement, including:

- initiating enforcement actions against assets, and

- taking steps that can lead to auction of the collateral

What to watch next

The servicing company will move toward enforcing and executing the Auction phase. At the same time, because completing the full Recovery Flow through the Auction stage can require additional time and dilute investor yield, the servicing company will, in parallel with execution, focus on selling the debt on the institutional debt secondary market as the preferred alternative exit strategy for this case.

In parallel, out-of-court negotiations with the debtor have intensified. The debtor’s position is now weaker, so we expect the terms of any settlement discussions to be more favorable for investors.

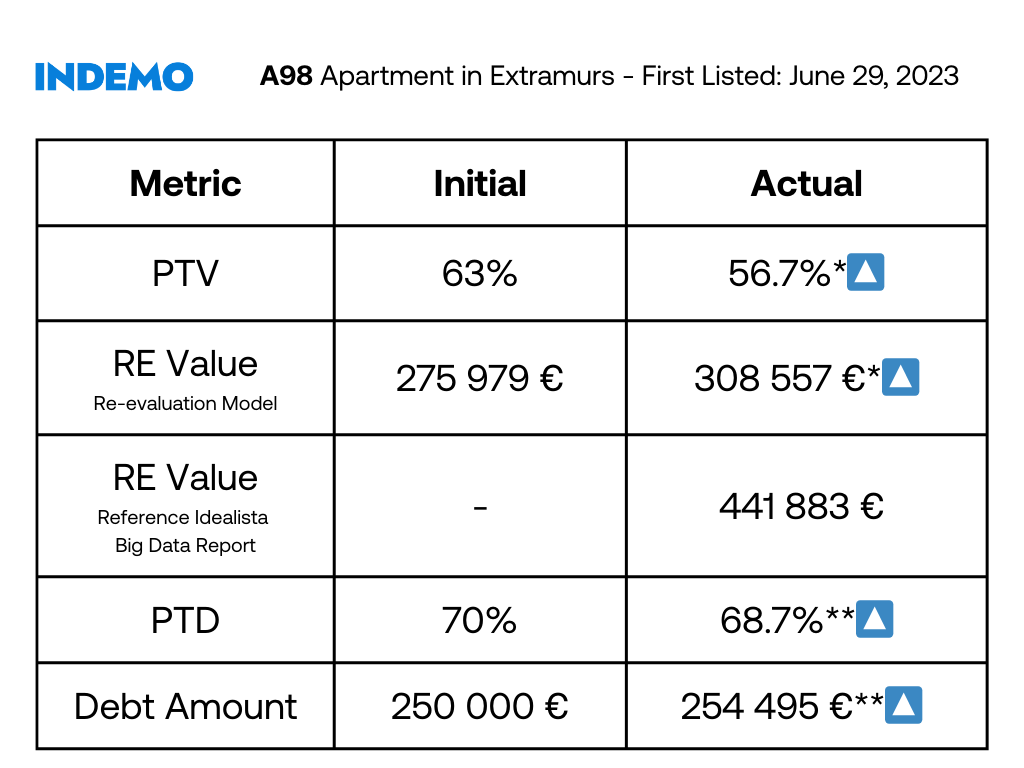

A98 Apartment in Extramurs

Valencia - Current Flow Stage: Auction Preparation (Step 10) (since May 16, 2024)

Key achievements

At the end of 2024, the debtor filed a tactical opposition to slow down the foreclosure process at the auction preparation stage. In autumn 2025, the legal team successfully rejected that opposition, putting the case back on track for auction preparation.

However, continuing through the auction stage — and potentially into real estate takeover — would have required additional time, diluting investor yield and pushing the case beyond the 24-month target. For that reason, the servicing company made the decision to seek an institutional buyer and sell the debt at a premium. This was successfully executed in February 2026.

What to watch next

The debt was repaid to Indemo investors through a sale on the institutional debt secondary market.

Read more: https://indemo.eu/blog/first-discounted-debt-repayment-of-2026

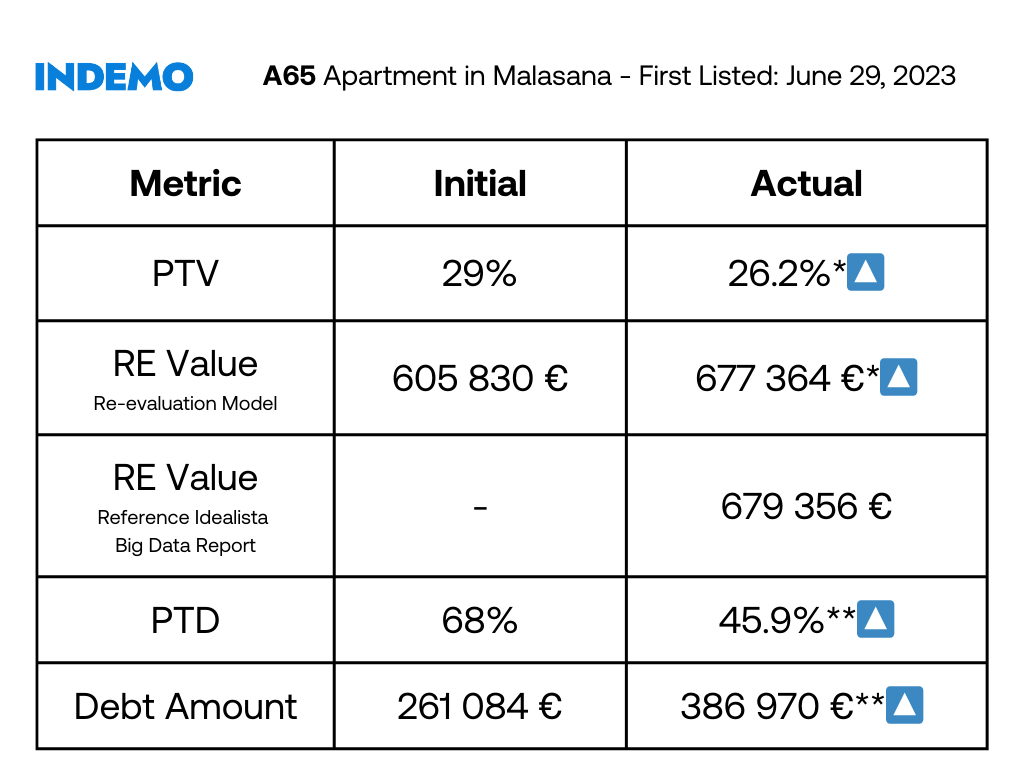

A65 - Apartment in Malasana

Madrid - Current Flow Stage: Appeal (Step 9) (since Aug 04, 2023)

Key achievements

On the platform, this case appears in the Appeal stage. Under the hood, the debtor’s actions triggered a tactical legal approach: the legal firm paused the standard foreclosure (execution) sequence and initiated additional steps designed to (1) strengthen the servicing company’s procedural position as creditor, and (2) reduce risks and delays at the enforcement stage.

This case is outside the usual scenario: the debtor has taken an unusually aggressive approach, using appeals and additional legal actions to create delays. For that reason, the legal team has applied extra protective steps to safeguard investor interests and keep the recovery process as efficient as possible.

After the debtor filed an appeal within the main foreclosure process, the legal team prioritized securing a clean and robust judicial basis that:

- Confirms the servicing company’s position as creditor, removing room for procedural objections and technical challenges

- Improves enforceability and reduces uncertainty during execution

As mentioned above, this step was successfully resolved, and the servicing company has already requested the continuation of the execution. However, the second-instance court — Audiencia Provincial de Madrid (Madrid Provincial Court) — requires one additional procedural confirmation before allowing the execution to move forward:

- The court needs a definitive resolution/certification confirming that the debtor did not file a cassation appeal (the last-level appeal route).

- Until this confirmation is officially on record, the court typically will not permit the execution to continue, to avoid procedural risk.

Once the court confirms that no cassation was filed (or the filing deadline passes and this is formally certified), the execution proceeding should be reactivated — likely within the next weeks — and the foreclosure/enforcement process can continue with stronger procedural protection.

What to watch next

The servicing company will move toward enforcing and executing the Auction phase. At the same time, because completing the full Recovery Flow through the Auction stage can require additional time and dilute investor yield, the servicing company will, in parallel with execution, focus on selling the debt on the institutional debt secondary market as the preferred alternative exit strategy for this case.

In parallel, out-of-court negotiations with the debtor have been attempted several times, but without result so far, as the debtor currently lacks sufficient free funds to settle at the current outstanding amount.

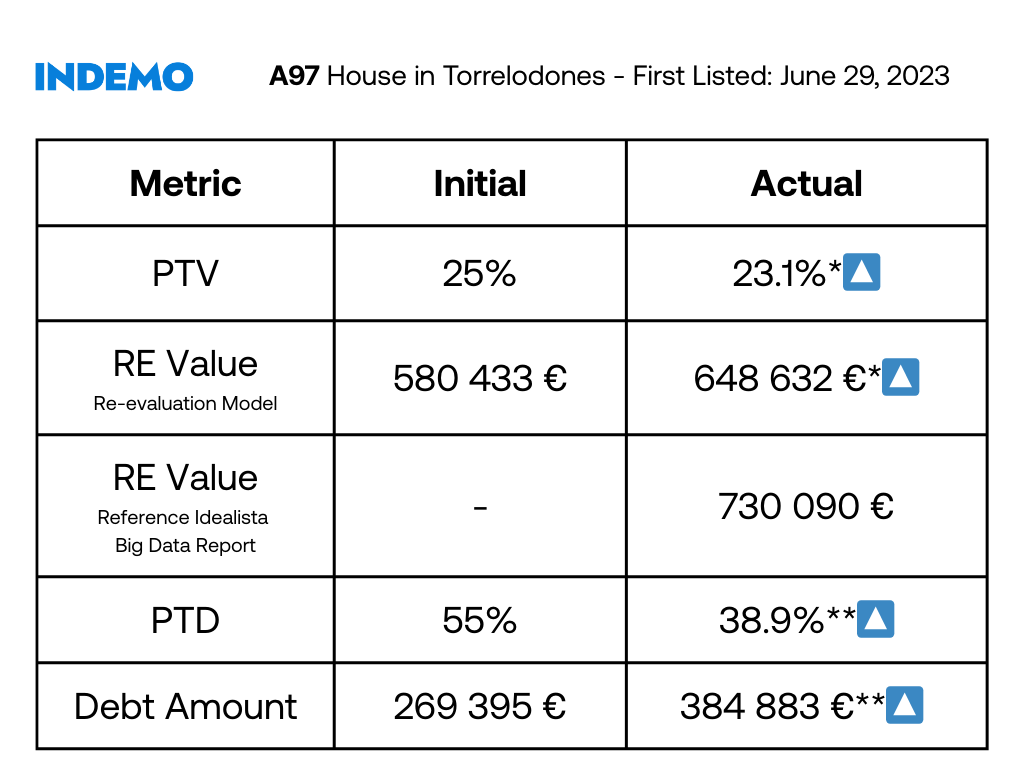

A97 - House in Torrelodones

Madrid - Current Flow Stage: Court Decision on Opposition (Step 8) (since Jan 31, 2024)

Key achievements

On the platform, this case appears in the Opposition stage. This is not a standard situation — it’s an exceptional case driven by the debtor taking an active, disruptive approach, including filing procedural objections and additional legal actions. That’s why the legal team has implemented extra measures to protect investors’ interests and preserve recovery efficiency.

At the same time, this case is being handled by a highly overloaded and slow court, which is also impacting timelines.

The debtor has submitted an opposition arguing that the original loan agreement contained abusive clauses. This is a common defensive tactic used to slow down enforcement, because the court must first resolve this objection before the foreclosure execution can proceed with full procedural certainty.

The court is expected to make a decision on the debtor’s opposition regarding abusive clauses.

- A hearing was initially planned for January 2026

- It was rescheduled by the judge to March 2026 due to court workload

Until the court resolves this point, the execution process is effectively paused.

Once the court confirms that the opposition is rejected (i.e., the alleged abusive clauses do not prevent enforcement), the foreclosure execution proceeding should be reactivated and the case can continue to the next steps of enforcement.

What to watch next

The servicing company will move toward enforcing and executing the Auction phase. At the same time, because completing the full Recovery Flow through the Auction stage can require additional time and dilute investor yield, the servicing company will, in parallel with execution, focus on selling the debt on the institutional debt secondary market as the preferred alternative exit strategy for this case.

In parallel, out-of-court negotiations with the debtor have been attempted several times, but without result so far. In practice, once a debtor loses the opposition, they often become more flexible in out-of-court negotiations, because their procedural leverage is significantly reduced.

Bottom line (with a note from Indemo CEO)

The cases above show that successfully passing the appeal/opposition stage can materially strengthen the creditor’s position, shorten the expected time to exit, and clear the way for the final foreclosure steps. This also makes the asset more attractive to potential buyers, supporting a higher market price.

At the same time, Indemo’s purchasing and pricing model includes a substantial buffer (via PTV/PTD boundaries) and is designed to withstand even a worst-case timeline of up to five years without compromising the product’s target return. The current revaluation metrics for the selected debts support this assessment. Moreover, ongoing housing market dynamics and the continued increase of the outstanding debt amount over time further strengthen the long-term profit potential of discounted debt as an asset class.

As Indemo CEO Sergejs notes,

"We hear clearly that investors want a Secondary Market — and we want the same. At the same time, as a regulated fintech under MiFID, we have to balance limited resources, multiple stakeholders (including the regulator), and a complex regulatory perimeter. We also don’t want to ship “just another” secondary market like everyone else — we want to build it in a way that reflects Indemo’s vision for discounted debts (a product we were among the first to bring to private investors in Europe), with the right pricing logic and protections. That takes time — but the work is already underway.

It’s also important to remember that mortgage NPLs are fundamentally different from unsecured consumer credit: they are always backed by real residential collateral in Spain, and the product is supported by an institutional-grade pricing model, further strengthened by the long-term fundamentals of the Spanish housing market.

We are already seeing two clear approaches emerge among investors who have gone deeper into the product — strategies that will become even more practical once the Indemo Secondary Market is live:

- Early-stage claims: deeper discounts and higher upside, often driven by settlement potential and alternative exits before the full recovery flow is completed.

- Late-stage claims: lower discounts (higher PTV) but reduced timing risk, often leading to faster recoveries.

And finally, it’s worth repeating the core strategic principle shared by Indemo and our partners: maximize possible profit within the shortest realistic timeframe. If the only goal were the absolute shortest timeline at any cost, the return profile would naturally be weaker."

A Quick Recap

PTV (Price-to-Value) shows the purchase price of a debt relative to the appraised value of the underlying property.

PTD (Price-to-Debt) shows the purchase price relative to the outstanding debt amount. It is equally important because it reflects how the purchase price compares to what is contractually owed.

* Real estate value is not static. Markets such as Spain have shown long-term upward pressure, and our assumptions typically model ~4% p.a. on average (with variability by region and cycle). This is a deliberately conservative assumption when viewed against long-term housing price statistics over the last ~30 years.

** In most mortgage NPL cases, the claim amount increases as default interest accrues and legal/servicing fees are added. These figures are calculated and recorded by the legal team regularly (typically monthly).

Stay tuned for the next Discounted Debts: Behind the Flow episodes to explore the background of the selected cases!

Please share your comments and thoughts: what you’re most excited about, what you want to see next, and what would make the biggest difference for your investing experience.

Stay Updated on Indemo News:

📢 Telegram - Exclusive Indemo Community Chat featuring key Indemo stakeholders

📷 Instagram- Weekly content, Meet the Team, Weekly Stories

🎥 YouTube - Podcasts, expert insights, quarterly reviews, and giveaways

This content is a marketing communication. It shall not be treated as investment advice, independent research or offer, recommendation or invitation to invest in the investment opportunities referred to herein. The content is not aimed at promoting services or products to persons based in jurisdictions where the distribution of said information would be illegal.

Investing in financial instruments involves risk, and there’s no guarantee that investors will get back invested capital. Moreover, past performance does not guarantee future returns. Indemo SIA shall not be responsible for any direct or indirect loss from using the provided information.