Feature release: 1 Note : 1 Debt - More Control, More Flexibility

We’re excited to introduce a new style of Notes on Indemo. Starting now, each Note will contain just one Debt.

This change gives you more control over your portfolio, allowing you to decide exactly how much to allocate to each specific investment opportunity.

Here is a deep dive into the new updates:

*Disclaimer: The data in the screenshots is presented for demonstration purposes, obfuscated, and anonymized. Any coincidences are accidental.

Part One. Functionality directly related to 1 Note : 1 Debt.

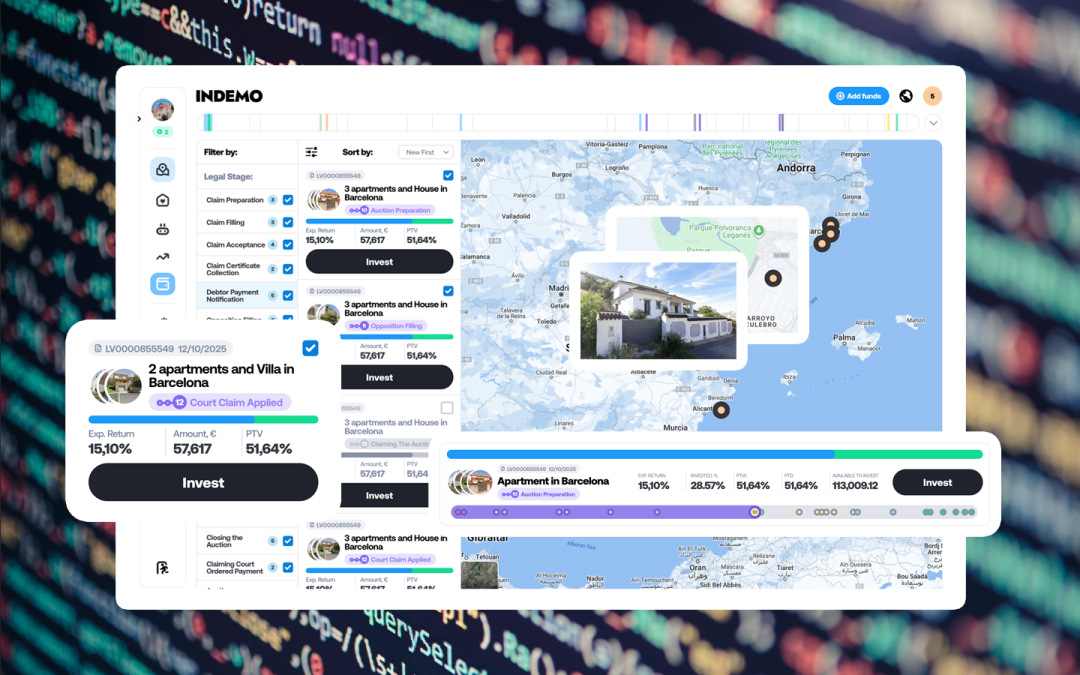

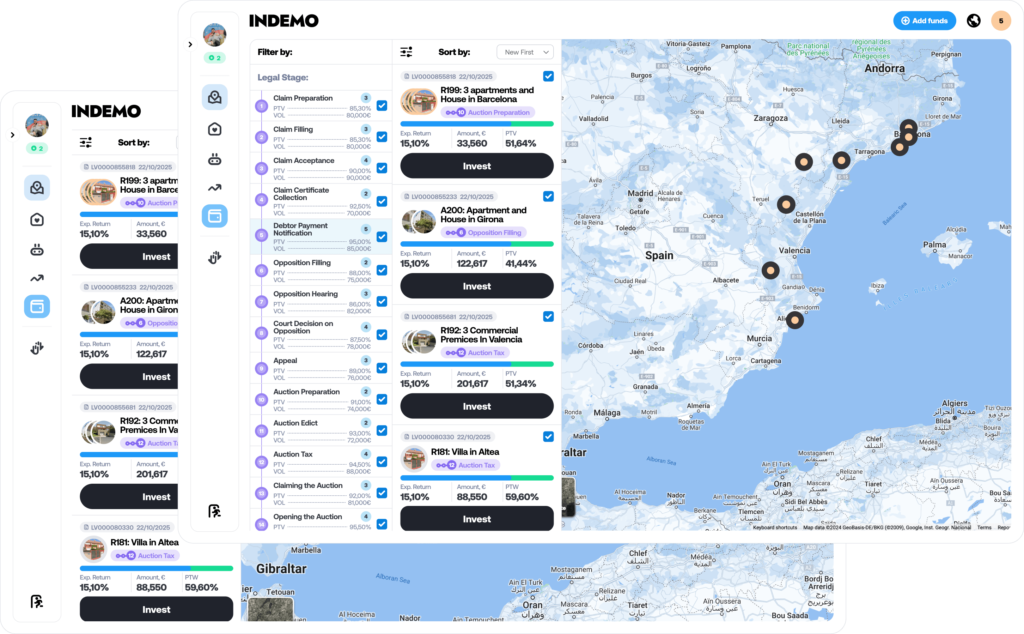

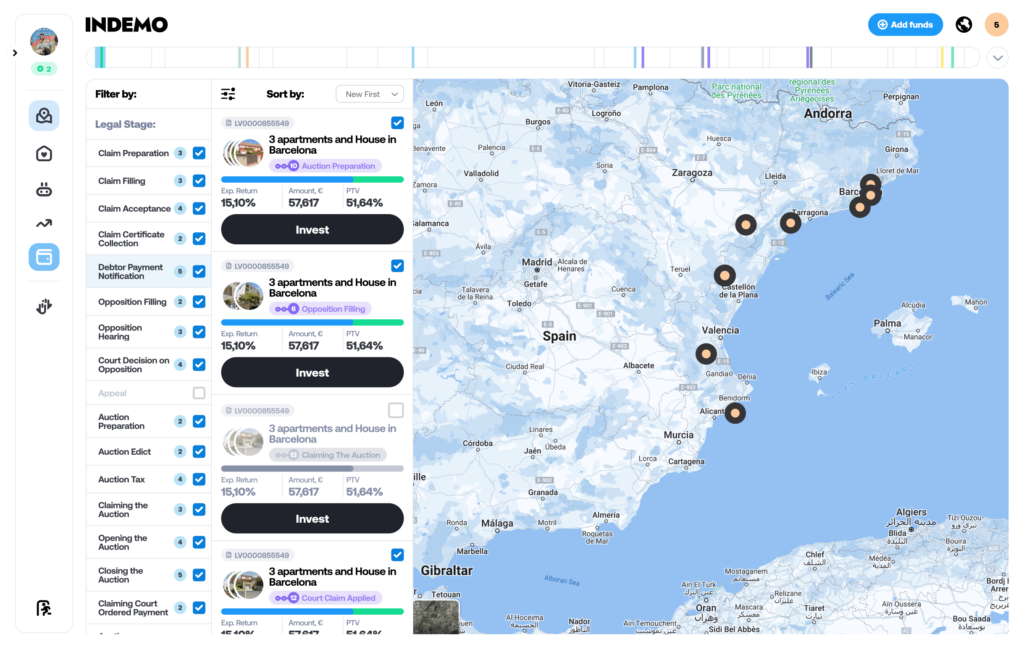

- Fresh Investment Screen

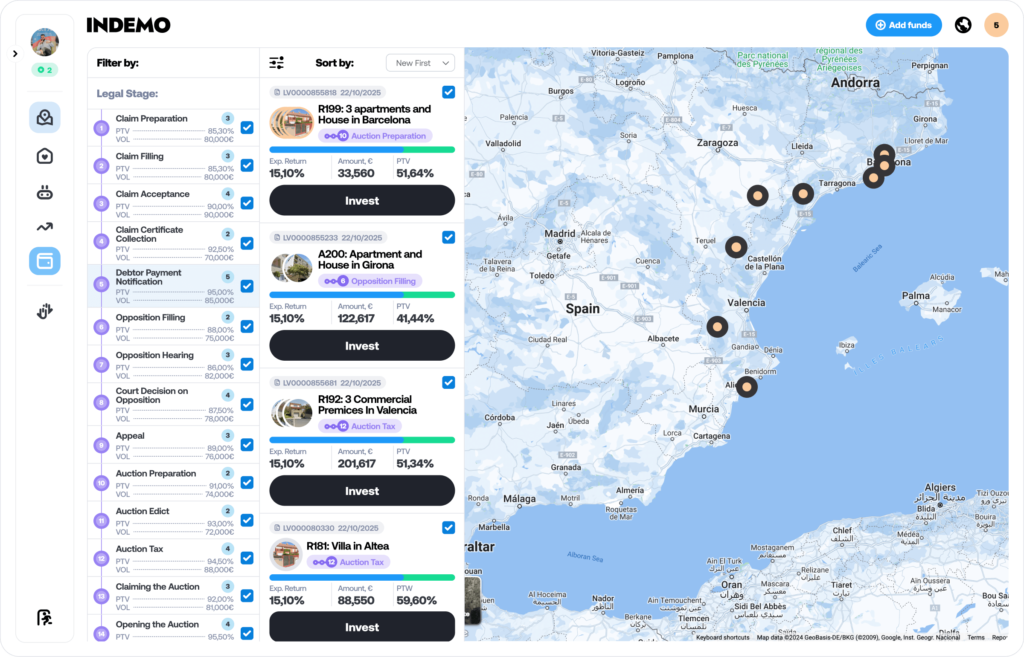

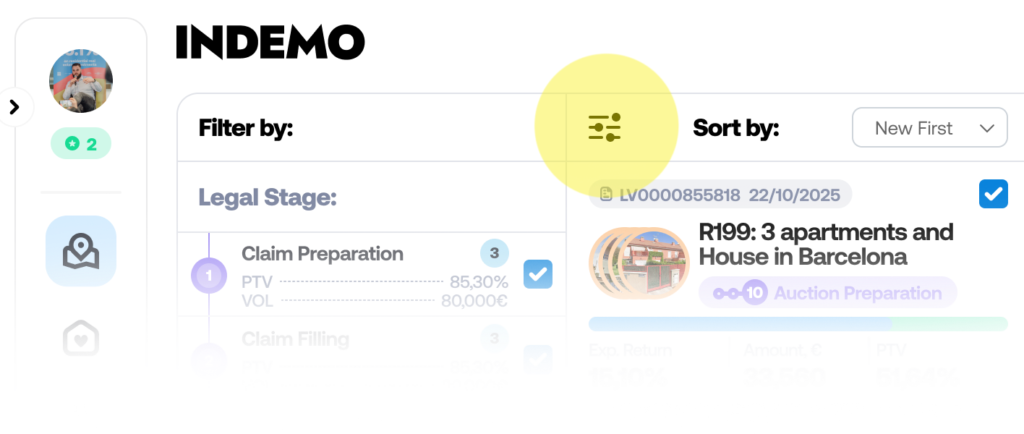

With the launch of our new functionality, the main investment screen has undergone a substantial redesign. The new layout brings clarity, structure, and convenience to investors — ensuring that every decision can be made faster and with better context.

The main interface elements have been reorganized from left to right: filters, cards, and map. Users can now hide or display filters according to their preferences for a cleaner workspace.

Let’s take a closer look at the innovations.

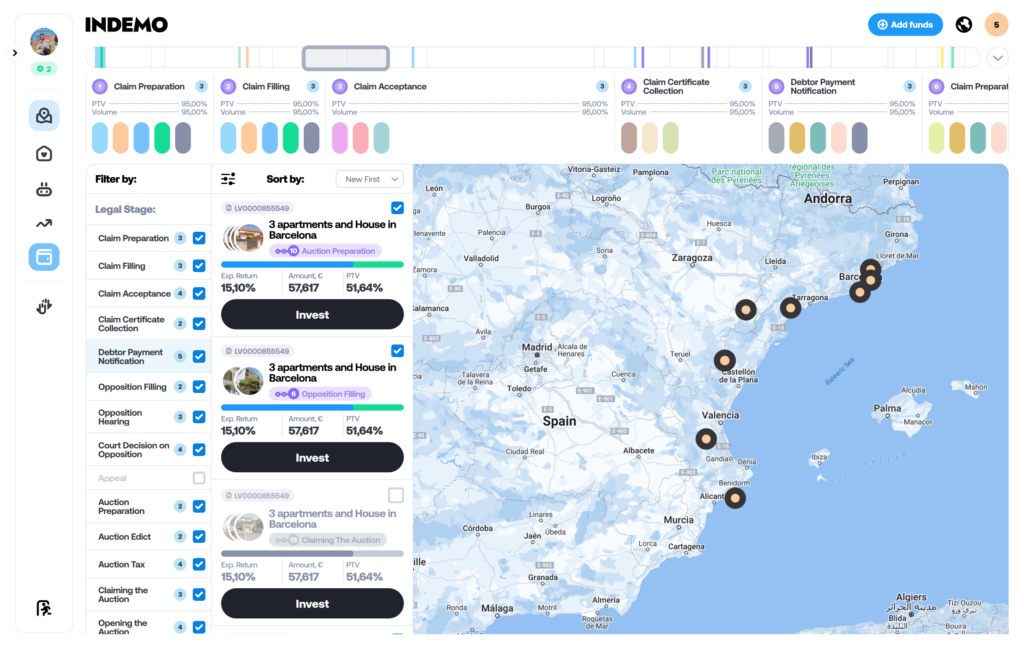

1.1 Stage Slider: A Helicopter View of the Investment Journey

The Stage Slider is a new interface element giving investors a helicopter view of the entire legal and investment process.

Current Location: Investment Screen

Coming Soon: Portfolio Screen

Key Features

- Visual Progress: See each stage of the legal process at a glance

- Stage Details: Future versions will show individual objects, PTV, and available investment volume (€)

- Flexible Views: Minimum version for quick overview, detailed version for full investment info

The Stage Slider makes it faster and easier to track investments, providing clarity across all stages of the process.

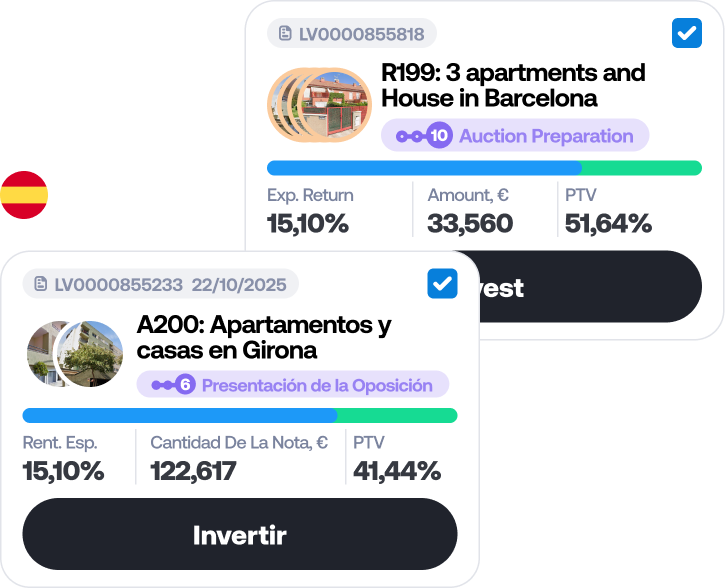

1.2 Object Cards: More Visual, Informative, and Intuitive

Working with investment cards is now more convenient than ever. Several major updates make navigation through opportunities faster and more intuitive:

New Naming Logic:

Each product card now displays not only the ISIN number but also a descriptive name reflecting the composition of debt and collateral. For example: “Apartments and House in Girona.”

Image Thumbnails:

Cards now include thumbnail images of the investment objects, giving investors an immediate visual impression of the underlying assets. The number of thumbnails corresponds to the number of collaterals in the NPL.

Localized Object Names:

Names of objects are now displayed in multiple languages — English, Spanish, Latvian, and German — ensuring accessibility and understanding for all investors.

Legal Procedure Icons:

Each card includes an icon that shows the current step and number in the legal process. This subtle yet meaningful addition helps investors instantly assess the stage of each product.

1.3 Filters: Tailored to Your Needs

Investor feedback is at the heart of our updates. Following a community survey in the Indemo Telegram channel, we’ve implemented new NPL filters — a long-requested feature.

As they say, you asked - we delivered. Meet the new interface element - filters.

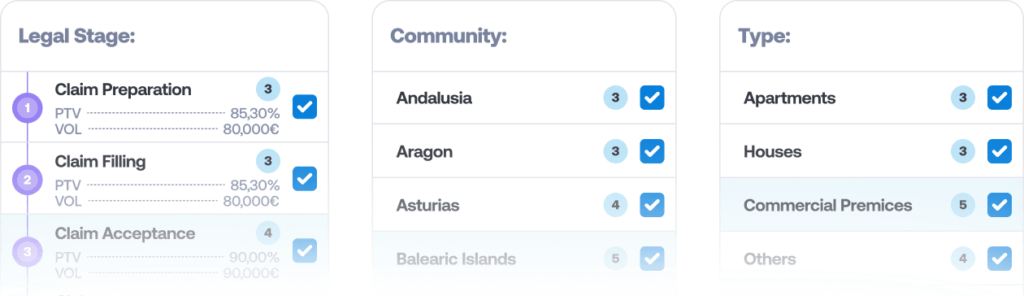

Filters Overview

Flexible Display: Filters are optional and can be easily hidden or shown with a single click.

Three Filter Types:

Legal Stage Filter: Displays stage number, number of objects, weighted average PTV of all notes, and total available investment volume.

Regional Filter: Filter by autonomous communities of Spain. (Coming Soon)

Asset Type Filter: Filter by asset types included in the note. (Coming Soon)

These enhancements make it easier to find the exact investment opportunities you’re looking for — faster and smarter.

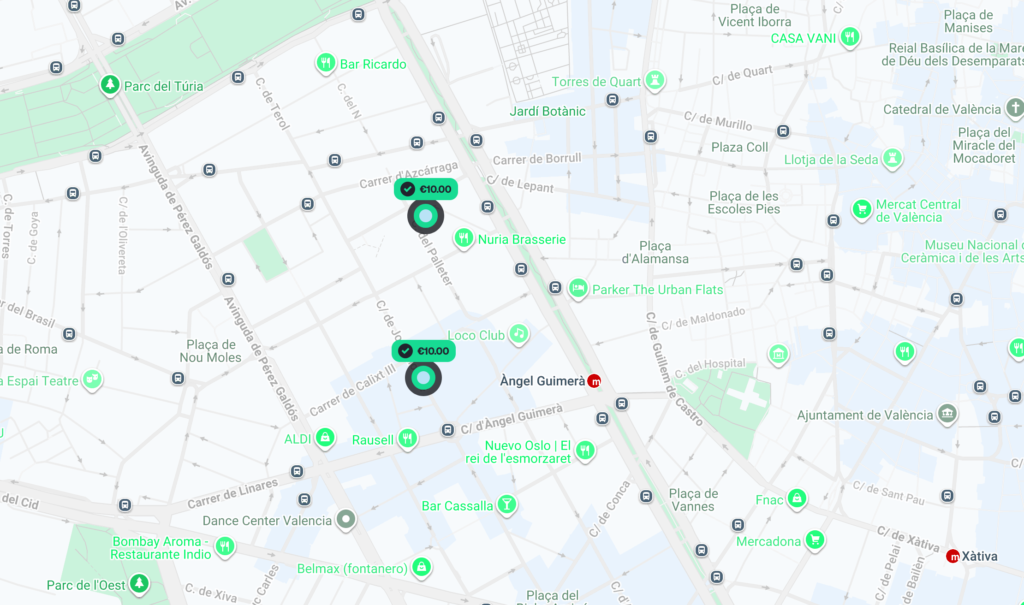

1.4 Map: Clear Visualization of Assets

The map view has been refined to display all collaterals included in a single note, especially for the 1=1 product format. If one NPL debt contains multiple collateral, each of them is now shown individually on the map, creating a comprehensive visual overview.

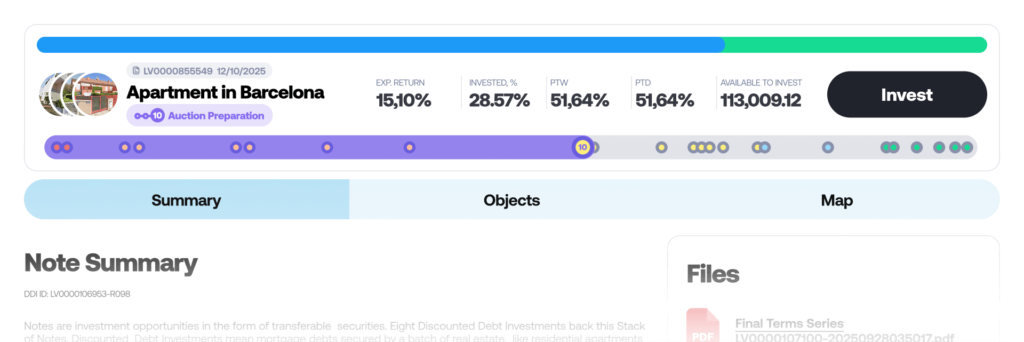

1.5 Note and Object Cards: Clearer Data, Better Structure

We’ve significantly improved how information is presented in note cards, particularly for Notes that include multiple collateral.

Updated Note Header

The new header now displays all the key attributes — Expected Return, PTV, PTD — along with a visual indicator of the note’s progress through the legal process. We will look at this important element in more detail later on.

Optimized Sections

We’ve streamlined the note tabs into three clear sections: Note Summary, Objects, Map

Each section presents related documents, valuations, and FAQs for easy reference.

Everything in its place: All key materials, such as files, documents, and valuations, are now neatly organized within their respective tabs for quick, intuitive access.

Refreshed performance tables: The Note Summary and Loan Details sections feature updated tables, making it easier to compare and interpret key investment metrics.

Built-in FAQs: Relevant questions and explanations are now embedded directly in these sections, so you can find answers instantly without navigating away.

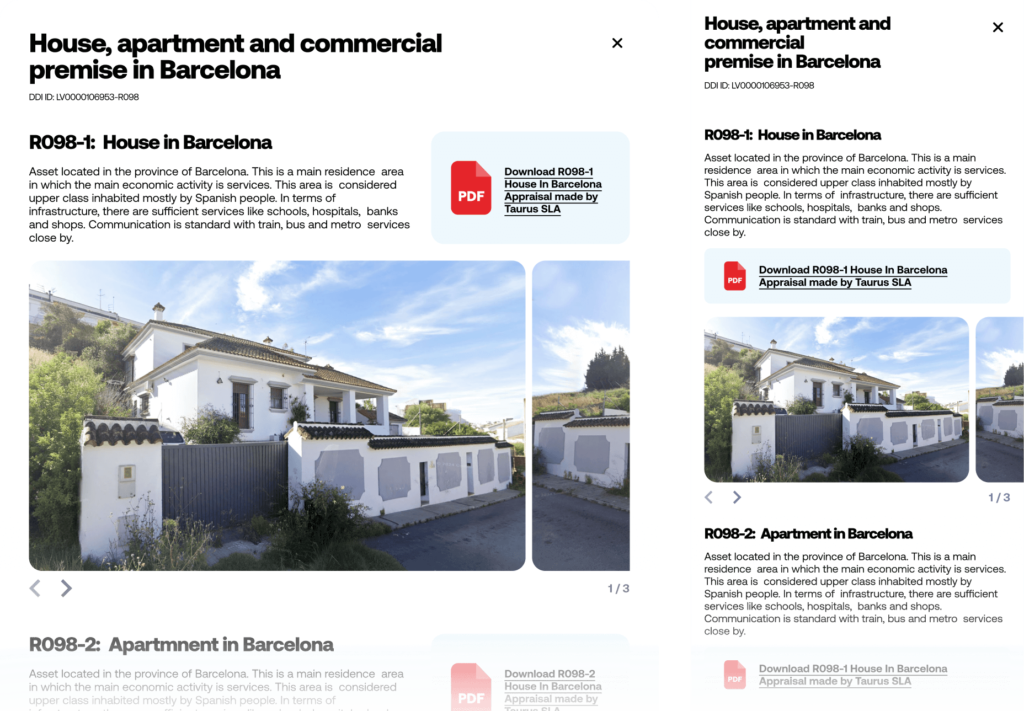

1.6 Fresh Look for Collateral Display

We’ve given the way collateral is displayed a major facelift, making it clearer, more visual, and easier to navigate — especially for notes that include multiple collateral items.

Here’s what’s new:

- New Universal View: Each collateral now appears in its own block, showing description, images, and valuation — everything you need at a glance.

- Multilingual Support: Names and descriptions are now available in Spanish, English, Latvian, and German, so everyone can understand the assets clearly.

- Mobile-Optimized Design: The screen has been fully refactored for mobile devices, delivering a seamless, smooth experience on any device.

This update transforms collateral from a simple data point into a visually rich, easy-to-digest overview, helping investors make faster, more informed decisions.

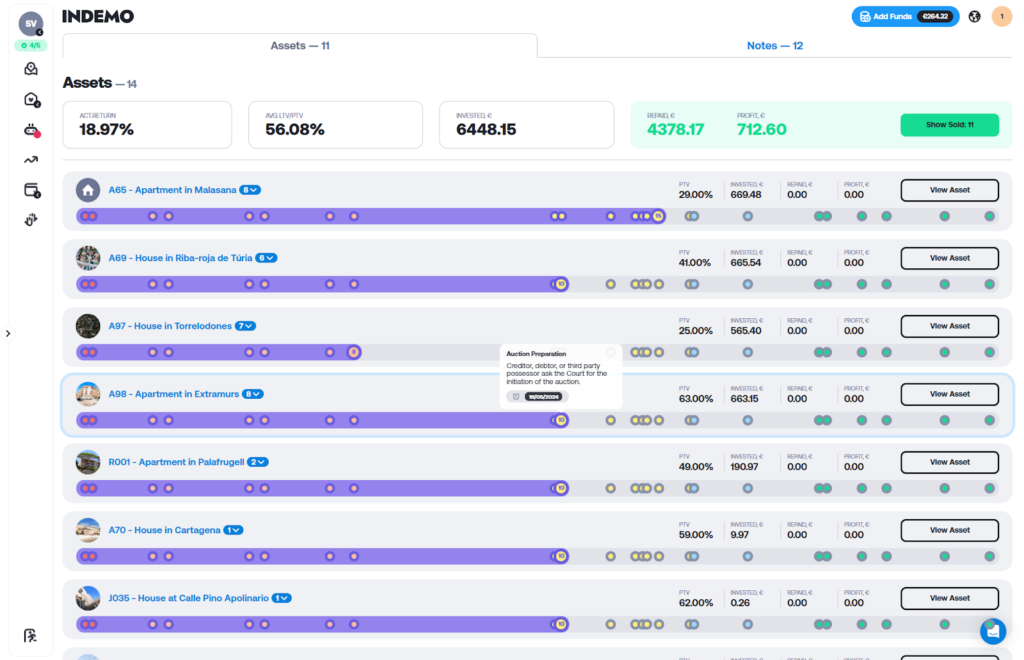

1.7 Portfolio and Assets Sections

We’ve completely reengineered the Assets section to make managing your portfolio smoother, faster, and more intuitive. The new logic behind this section ensures that every piece of information about your investments is easier to access and interpret — whether you’re tracking active Notes or reviewing sold ones.

In the Sold Assets section, you’ll now find a more structured and transparent view of your finalized investments. This update makes it simpler to analyze outcomes, review performance, and gain insights from past deals — all within a clean, organized interface designed to keep your portfolio management effortless.

Log in to see the changes for yourself

FAQs

Will the old type of multi-debt Notes still be available?

From the launch date of the new Notes type, only the new single-debt Notes will be offered.

This way, the system stays simple and avoids overloading resources. We are gathering feedback from the community. If there is strong interest in also bringing back the previous multi-debt Notes, we will take that into account for the future.

How will the move to a “One Note: One Debt” structure affect my existing investments?

Stay calm! Nothing changes with your investment experience on Indemo. The only thing you will notice is a new legal recovery flow which will bring clarity to your investment's progress.

Will each new Note be fully funded at once, or funded in stages?

They will be funded in parts so that your capital can start working from day 1.

Are there any risks or downsides to splitting Notes this way?

The gold-plated rule of investments - diversification - remains as it is. With the new filtering options you can ensure to diversify your investments with the many Notes on the platform.

How many Notes will be available to invest in at a time?

We know that our investors like when there is sufficient opportunities on the platform. Our goal is to list around 10 Notes weekly to provide supply to the growing demand for our product.

Will the pricing or valuation of Notes change under the new system?

With 1 Note : 1 Debt, pricing becomes much easier to understand and much more transparent. Now you can see the clear correlation between the Debt Recovery stage and the PTV (Price-to-value). It is now simpler to navigate.

Final Thoughts

The update comes directly in response to community feedback. Many of you (almost 99%) asked for the chance to invest in one Debt per Note, and we’re happy that our regulator, Latvijas Banka, gave us the green light to move forward.

Make sure to also check out our dedicated blog article for Flow 2.0 to dive in deeper to the Indemo Evolution!

This improvement is also an important step toward the launch of our secondary market, which will provide even greater flexibility and liquidity for your investments.

Thank you for continuing to shape Indemo with your feedback. We’re excited for what’s next.

Have something to say regarding this update?

We’d love to hear your thoughts! Please take a moment to fill out our feedback survey on 1 Note : 1 Debt Your input will help us continue refining and enhancing the experience for all investors.

Take our survey: https://forms.gle/c6CuvHp4BRnisZWr5

Stay informed on Indemo News by following our socials:

📢 Telegram - Exclusive Indemo Chat Content, where investors can connect directly with Indemo’s key stakeholders (part of how we decided to move to 1 Note: 1 Debt)

📷 Instagram/Facebook - Meet the team, Indemo Daily life, Special Promos

🎥 YouTube - Podcasts, Meet Indemo Experts, Quarterly Reviews

This content is a marketing communication. It shall not be treated as investment advice, independent research or offer, recommendation or invitation to invest in the investment opportunities referred to herein. The content is not aimed at promoting services or products to persons based in jurisdictions where the distribution of said information would be illegal.

Investing in financial instruments involves risk, and there’s no guarantee that investors will get back invested capital. Moreover, past performance does not guarantee future returns. Indemo SIA shall not be responsible for any direct or indirect loss from using the provided information.