Third Discounted Debt Investment Repayments!

We start the fourth quarter of 2024 with fantastic news for you!

It is repayment time once again!

We’re excited to announce the third wave of repayments for Discounted Debts.

With total repayments of 208 317 euros across 41 Notes affecting about 36% of our community. This marks another incredible milestone for both the Indemo platform and our community of investors. The actual ROI for investors' portfolios has ranged between 15% and 36% per annum.

When we introduced Discounted Debts as products on the platform, we knew we were bringing something fresh to the table. Discounted debt investments had never been offered to retail investors before, so introducing them as a new asset class really changed the game.

This is now the third wave of repayments for investors in 2024. We hope that we will not end up here and will announce a couple of new Debts repayments by the year end. From the beginning, our goal was to democratize this market, and offer ordinary people extraordinary investment opportunities that were previously only available to the mega-wealthy. Thanks to your support, we’re taking steps towards that goal!

The repaid debt: A62 - Apartment in Tossa de Mar

All of the Discounted Debt Investments we offer on the Indemo platform are backed by residential properties in Spain. This property is no different.

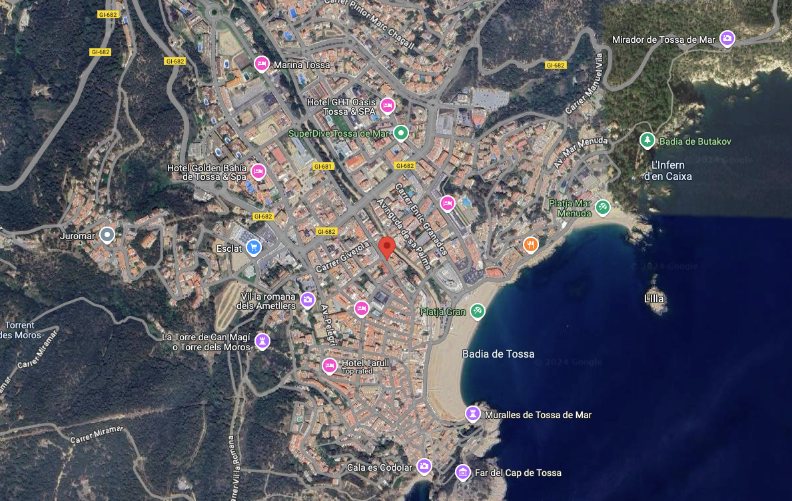

The A62 mortgage Debt, from which repayments have been made, is backed by an apartment in a residential building with a terrace located at Avenida Costa Brava, in the municipality of Tossa de Mar, belonging to the region of La Selva and the province of Girona, located southeast of Girona capital. Found in the center of Tossa de Mar, where neighborhood stores predominate. The apartment had 113 square meters and was built in 2001.

The Debt was first listed on the Indemo platform in November 2023, with the Flow stage of “Auction Initiated” with a Price To Value of 70%. Throughout its tenure on the platform, the debt underwent several Flow stage changes, eventually reaching the “Access to Estate” stage.

The debt was sold on the secondary market to a debt buyer who focuses on the post-auction stages.

Our partner servicing company works through the legal process required to recover the debts, with the aim of discharging it as quickly as possible, at the highest possible returns. They decided that selling the debt to another buyer was the optimal choice, and thus achieved the fastest exit, and return for investors starting at the threshold of 15% p.a.

Keep in mind

Investors in multiple notes in the same debt may notice that the returns on one are higher than the other. This is usually down to one investment being made earlier in the flow than the other.

As a general rule, it’s a good habit for investors to pay close attention to the dates the Discounted Debt Investment was released on the platform, along with the stage in the flow it is at and PTV..

Next steps

Investors who’ve received returns on the A62 mortgage debt can track their returns in the Portfolio section of the platform, as well as the Analytics area.

Put your new capital to work for you by reinvesting in other notes available on the platform. The notes currently available provide a good variety of risk, from lower investment prices for early stages in the debt recovery process, to higher prices for later stages.

If you’re new to Indemo, Click here to sign up and make your first deposit and investment. If you already have an account, head to your home area and check out the other Discount Debt Investments we have available!

Whilst past performance is of course not a guarantee of future results, the fact that our investors are getting returns on such an innovative product offering is a fantastic sign. We’ll continue to provide unique investment opportunities to everyday people, and we’re so excited to share more news and updates throughout the rest of this new quarter. Stay tuned!

This content is a marketing communication. It shall not be treated as investment advice, independent research or offer, recommendation or invitation to invest in the investment opportunities referred to herein. The content is not aimed at promoting services or products to persons based in jurisdictions where the distribution of said information would be illegal.

Investing in financial instruments involves risk, and there’s no guarantee that investors will get back invested capital. Moreover, past performance does not guarantee future returns. Indemo SIA shall not be responsible for any direct or indirect loss from using the provided information.