Indemo announces groundbreaking Secondary Market concept

We’ve got some exciting news to share with the Indemo Investor Community and beyond. We’re delighted to announce that we’re actively working on adding secondary market functionality to the platform.

As we continue to power forward on our mission to achieve investment democracy, we’ve received a ton of feedback from our users. Our promise has always been to help everyday investors access products that are usually reserved for institutional investors, whilst achieving the same freedom and flexibility of familiar investing platforms.

The large institutional players in the debt market have always enjoyed the ability to sell debt investments before they’ve been recovered. The way we see it, why shouldn’t everyday investors have the same option? The secondary market on Indemo will more accurately mirror the market conditions and rules of the huge players, but for individual, everyday investors like yourselves.

Adding this functionality to the platform has been a priority of ours since we launched Indemo in 2023, and we’re truly excited about the opportunities it will bring our investors.

So what is a secondary market, how does it work, and why is this such a profound moment for Indemo and our community?

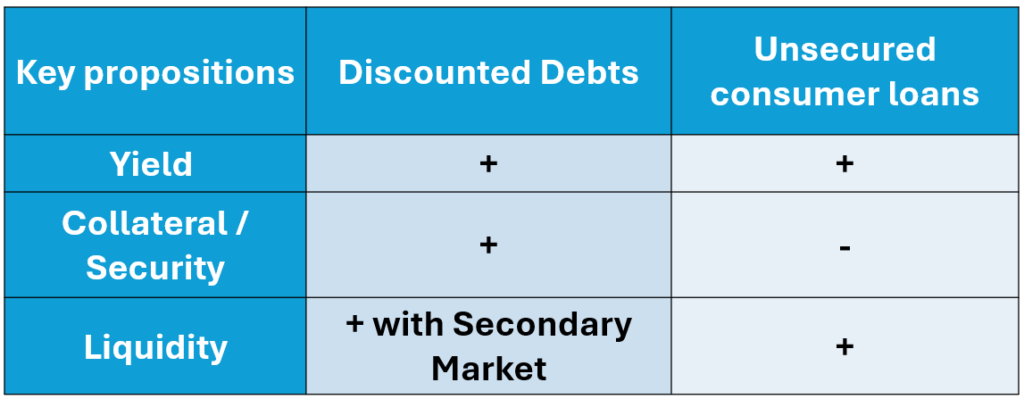

Some investors perceive the secondary market as a place where they may need to sell assets at a loss, typically whilst under pressure to do so as fast as possible. When it comes to debt however, the potential value of an asset actually increases as each stage of the recovery process progresses - making the secondary market a powerful place to exit investments at a premium.

With the secondary market on Indemo, investors have the ability to sell notes quickly, but without sacrificing profit, and not under duress. They’ll be able to execute creative strategies and trade notes in a way that maximises flexibility and ROI potential. The goal from all of this is to help investors achieve the same ROI but in a faster, more liquid manner.

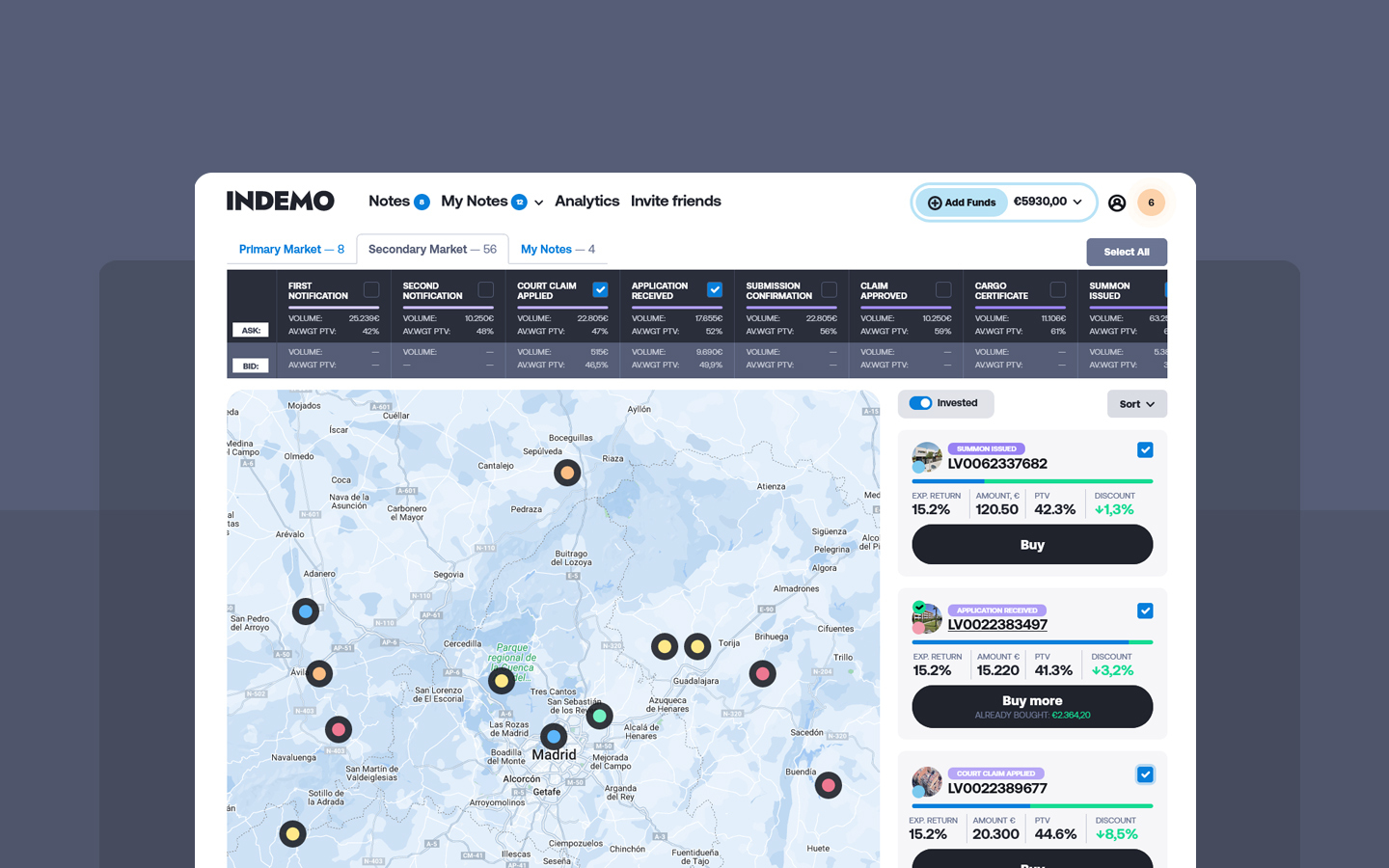

In the global non-performing loan (NPL) market, the price of a debt rises as it progresses through the debt recovery procedure. The closer the asset is to maturity, the higher its value. This will now be reflected within Indemo on the secondary market - meaning investors won’t need to wait until the final stages of maturation to make a profit, as they can sell the debt at any point in the recovery process. Information about supply and demand of a debt will be clearly displayed, allowing investors to understand the relationship between recovery stage and price, and plan their trades accordingly.

This is huge news for the Indemo community, marking the first time investors will be able to invest in products, and then choose to sell those investments at any point in the legal recovery phase. Rather than waiting for the debt to be recovered in full, they’ll be able to sell it to someone else at a premium before it matures, or at a minor discount if circumstances require it.

The secondary market on Indemo will operate differently from a traditional secondary market - removing the concept of having to sell investments at a loss quickly, and instead providing amazing opportunities to make more profit, faster than ever. It opens up both medium and short term trade opportunities, and increases the likelihood of discounted debts outperforming more traditional P2P products on the market, such as unsecured consumer loans with short life cycles.

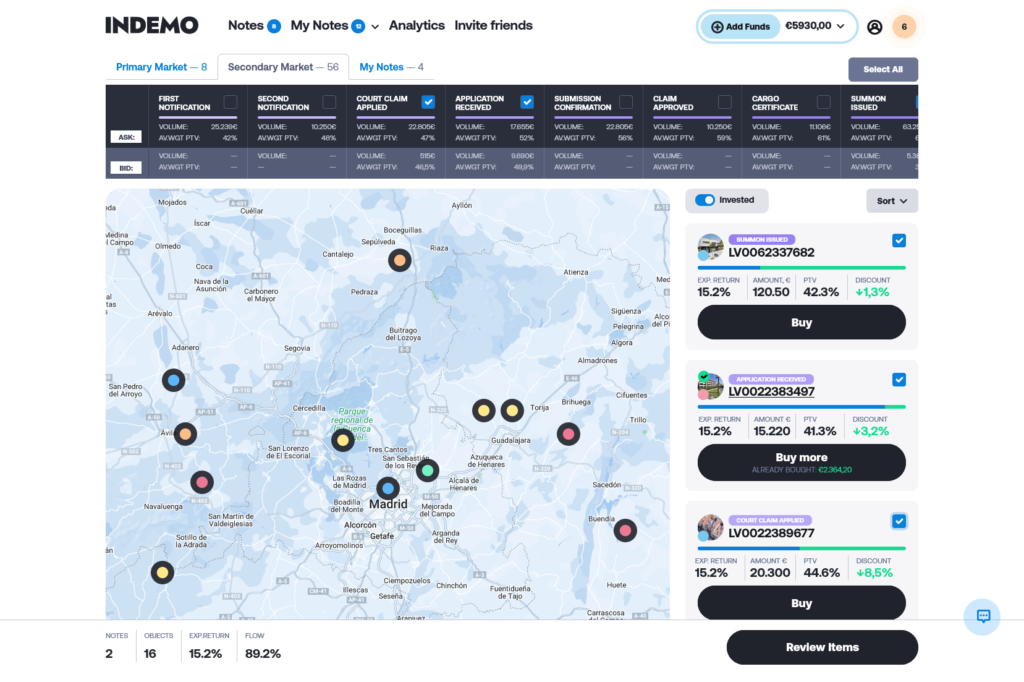

The new functionality will provide powerful opportunities for our investors to explore strategies that involve purchasing early stage debts, and selling them to other investors at a later stage in the recovery process at a premium, shortly before they mature. Investors will have all the market information at their fingertips, allowing them to form their strategy according to trends and real time data.

Additionally, rather than investing in one note that is attached to a bundle of up to 8 debts, investors will be able to trade single discounted debts, or use our new AutoInvest features to form a smart bundle - meaning more flexibility, and greater control over investments.

One of the best parts of this, is that the secondary market will be made up not only by Indemo users, but also our partner servicing companies, who will engage in both buying and selling. This will ensure that the secondary market is always active, whilst adding essential liquidity and providing even more trading opportunities for our community.

The feature will be complimented by a streamlined and visual new interface that combines vital information about Notes from both the primary and secondary markets, along with clear and objective supply and demand data. This information will help our investors assess opportunities, explore future potential, and make informed decisions on which products to buy, and when to sell them - a feature that any stock investor will find familiar.

In summary, investors will be able to benefit from Indemo’s new secondary market functionality in the following ways:

- Increase exit speed by selling your investment at any point in the recovery process at a premium. Your Debts become liquid, meaning no long waits before exit.

- Spot market trends and build strategies similar to the fixed income bond market, where the price of a security increases the closer it gets to maturing

- Visualise supply and demand data for each Debt

- Buy and sell individual Debts rather than bundles, with significantly increased supply

- Trade and interact with fellow Indemo members and professional suppliers

- Realise personal buy and exit strategies

- Access key primary and secondary market information and trends, helping stay informed and make objective decisions

- Leverage new AutoInvest features to select more strategic and flexible entrance and exit strategies through powerful algorithms

The introduction of a secondary market on Indemo marks the first time that Non-Performing Mortgage Loans, or as we call them on Indemo, Discounted Debt Investments, will be bought and sold between everyday people - a significant and radical step in our mission to improve accessibility across the investment world.

The whole Indemo team is working hard to release this functionality as soon as possible. In the meantime, we’d love for you to leave your suggestions, feedback, and ideas on the new secondary market function concept in the feedback form here:

Click here to leave a suggestion, feedback, or ideas on the new Indemo Secondary Market

Remember, we’re working on developing the Indemo Investors Academy, which will become an invaluable resource in helping you understand how the debt market performs, its trends, how pricing is set, and how the recovery stages of a debt influences its pricing.

We will be sharing key development updates with you all during the next few months, so stay tuned, and get involved!

This content is a marketing communication. It shall not be treated as investment advice, independent research or offer, recommendation or invitation to invest in the investment opportunities referred to herein. The content is not aimed at promoting services or products to persons based in jurisdictions where the distribution of said information would be illegal.

Investing in financial instruments involves risk, and there’s no guarantee that investors will get back invested capital. Moreover, past performance does not guarantee future returns. Indemo SIA shall not be responsible for any direct or indirect loss from using the provided information.