Newly Reshaped Portfolio Section: Easily Tackling Your Returns and Performance

As an investor, you may be eager to understand how the recent debt recovery we just announced impacts your Notes portfolio, your returns, and your overall investment performance. To make our customers' lives easier, we've just reshaped the Portfolio view on our platform.

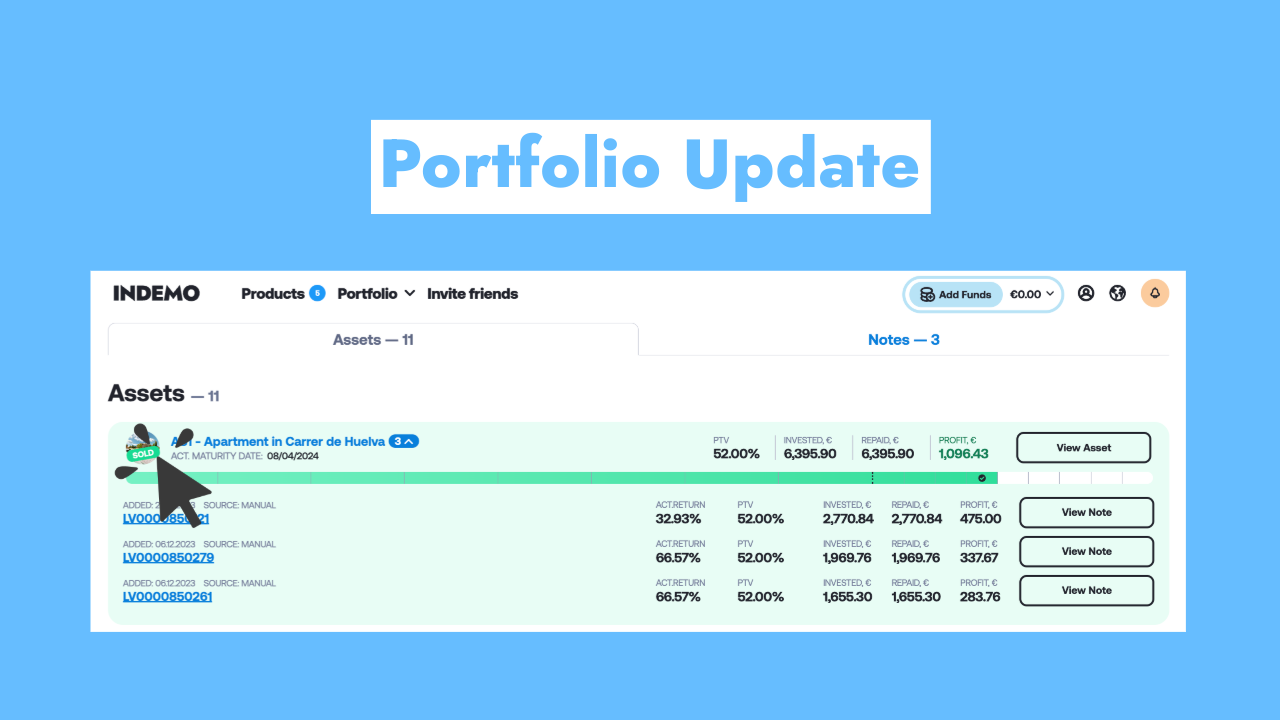

Through clear print screens and detailed explanations, we guide you through interpreting your results, ensuring a seamless understanding of your investment performance.

Please sign into your Indemo profile and check whether the notifications icon is flashing in the right upper corner. If so, push to open it.

Here you can see all the updates related to the debts you have been exposed to, including repayments and changes in the recovery Flow stages.

You can see the notification that A81 debt is repaid. You can also have a detailed look at the repayment result either by clicking on the hyperlinked name of the debt or navigating to the newly reshaped “Portfolio” section of the platform.

In the Portfolio, you can choose the dual view, either to the list of particular Debts you have exposure to, or through Notes you have invested into.

In the Portfolio, you can choose the dual view, either to see the list of particular Debts you have exposure to, or through the Notes you have invested in.

Let's take a closer look at the Assets view first. For debts that have been recovered, you will see the “Sold” stamp on the icon. Additionally, you will find the following information:

- The monetary exposure in the debt you currently have.

- The amount of money you have recovered from the debt as your initial investment repayment.

- The amount of profit (interest) you received from the debt recovery.

By tapping on the debt, you can have a detailed view of the list of Notes you have invested in, through which you get exposure to this particular debt.

Here, you will also find a very important figure, "Actual Return," which shows the return on investment (ROI) or how efficiently your investment generated profit over the time period. Considering that each of your Note investments was made at a particular time (shown on the left side above the ISIN), the ROI % varies.

When switching to the Notes view, you can see all the Notes you have invested in (your Notes portfolio).

Light and solid green circles will show up for Notes where the Flow changed for the underlying debt or where the debt was recovered.

Here, you can also see how debt repayments (e.g., A81) impacted the gradual repayment of the Note and the total profit earned. Additionally, you can see the Flow index indicating how close the Note is to reaching maturity.

By tapping on the Note, you can have a detailed look at the list of debts you have exposure to, and also identify the debts which have been recovered, such as A81, or are still in the active recovery stage.

Last but not least, you can have a look into the Statement and sort/filter, and create a statement Excel file if you want to see the list of all transactions the debt recovery has created, such as investment repayments, interest payments, and tax withheld.

Join our vibrant Telegram community and be part of the conversation! We value your feedback on our new Portfolio view—tell us what you liked, what didn't quite hit the mark, and any suggestions you have to make it even better. Alternatively, feel free to drop us a message via the chat widget on our website. Your insights are invaluable in shaping our platform to best suit your needs. Let's collaborate to create an outstanding user experience together!

This content is a marketing communication. It shall not be treated as investment advice, independent research or offer, recommendation or invitation to invest in the investment opportunities referred to herein. The content is not aimed at promoting services or products to persons based in jurisdictions where the distribution of said information would be illegal.

Investing in financial instruments involves risk, and there’s no guarantee that investors will get back invested capital. Moreover, past performance does not guarantee future returns. Indemo SIA shall not be responsible for any direct or indirect loss from using the provided information.