Why Indemo Focuses on Spanish Real Estate Investments

At Indemo, we’re often asked why we focus on investment products sourced from Spain rather than other countries. Our connection to Spanish real estate is a major part of our brand, and our product offering. We thought it would be valuable to share what makes working with this country such an attractive prospect for our investors.

We think that when investing in real estate backed investment products, it’s important to access key information about the country the real estate is actually in. Investors should at the very least, have a basic understanding of factors including the country’s risk profile, potential, economic factors, and of course, housing market and future outlook.

We’ve teamed up with Indemo co-founder and equity investor - asset management company Aquarium Investments to prepare a comprehensive and expert overview of the Spanish economic situation and real estate market - helping you understand why we picked Spain as the source of our investment products.

Economy of Spain in the 21st Century

Euro Adoption and rapid growth period (1999-2007)

Spain officially adopted the euro in 1999 which facilitated trade and investment, contributing to economic growth averaging around 3-4% annually. The construction and real estate sectors boomed, driven by low interest rates which the status of a Eurozone member provided and increased foreign investment.

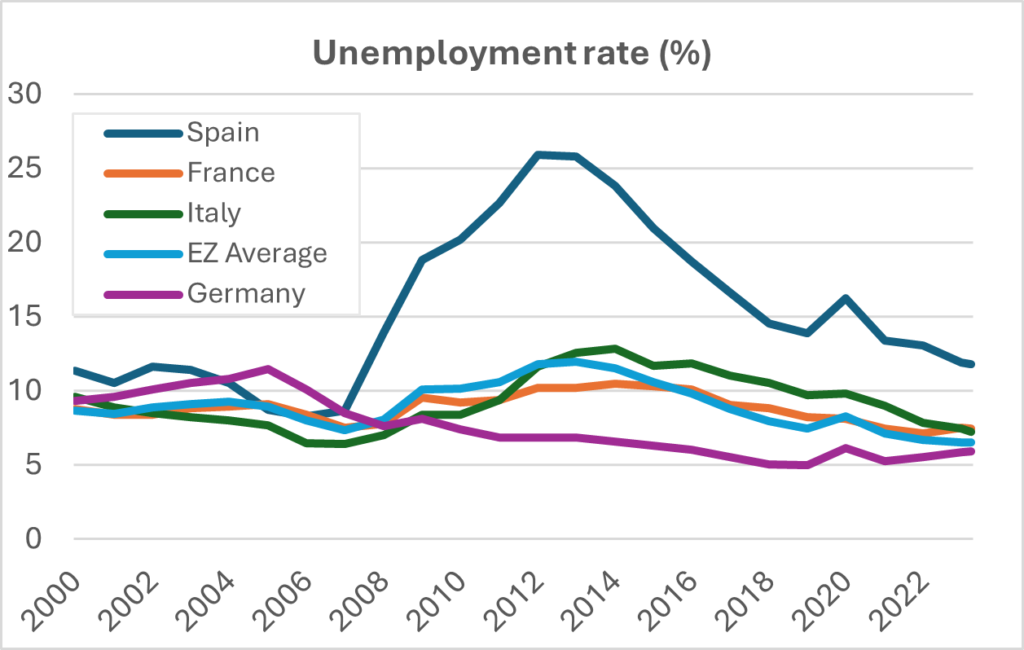

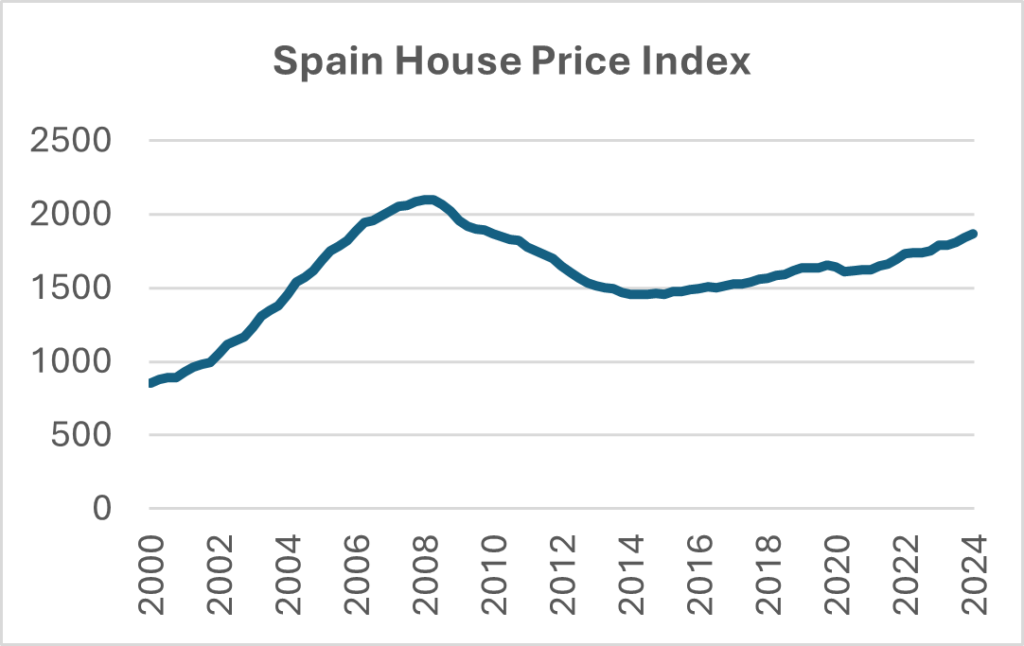

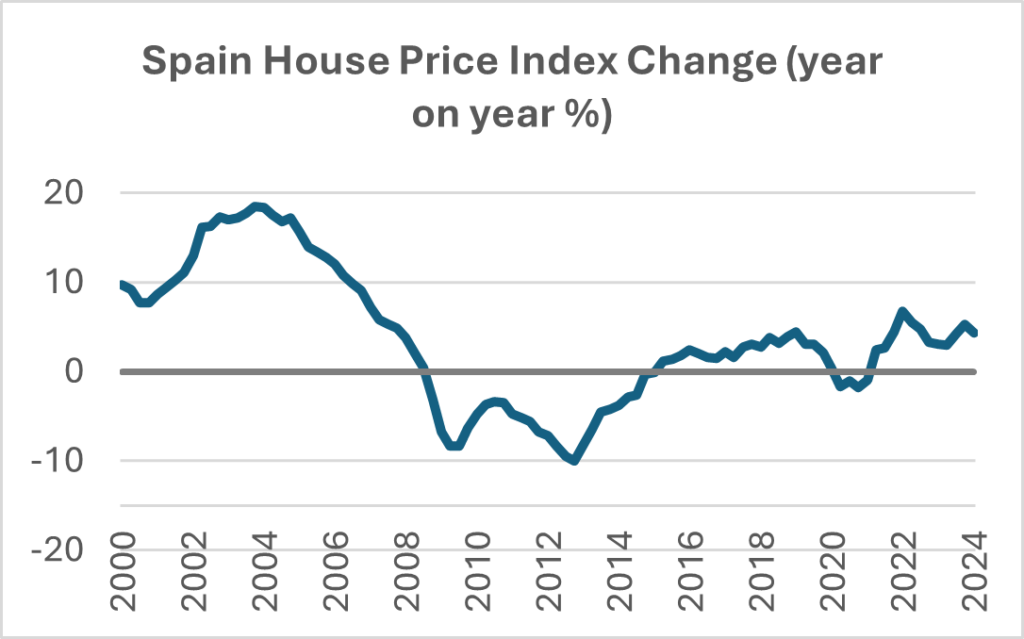

Employment surged, and unemployment dropped to historical lows, reaching about 8% in 2007. Over the five years ending 2005, Spain's economy had created more than half of all new jobs in the EU. This led to a significant housing boom with property prices soaring. At the top of its property boom, Spain was building more houses than Germany, France and the UK combined, and home prices soared by 71% between 2003-08, in tandem with the credit explosion, often with lax lending standards.

Global Financial Crisis and European Debt Crisis 2008-2014

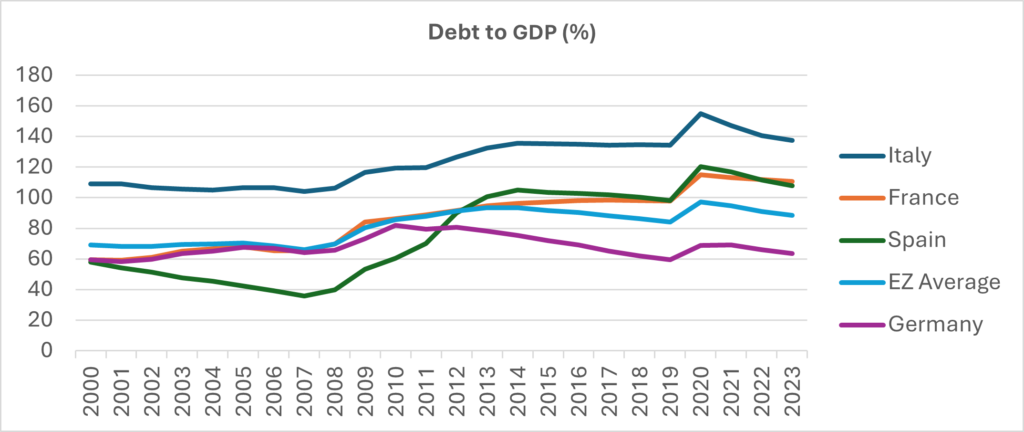

The bubble imploded in 2008, causing the collapse of Spain's large property related and construction sectors, causing a surge in unemployment and a collapsing domestic demand for goods and services. As the recession deepened and property prices slid, the growing bad debts of the smaller regional savings banks, forced the intervention of Spain's central bank and government through a stabilization and consolidation program, taking over or consolidating regional banks, and finally receiving a 100-billion-euro bailout from the ECB in 2012. Following the 2008 peak, home prices plunged by 31%. The government implemented austerity measures, including spending cuts and tax increases, to stabilize public finances. Structural reforms aimed at labour market flexibility and competitiveness were introduced.

Recovery and Growth (2014-2019)

Spain began to recover in 2014, with GDP growth returning to positive territory. Economic growth averaged around 3% annually from 2014 to 2019. Unemployment gradually declined but remained relatively high, particularly among youth. Labor market reforms helped improve employment rates and job creation. Tourism became a major growth driver, with Spain becoming one of the world's top tourist destinations. Exports diversified and increased, supporting economic growth. Fiscal consolidation efforts reduced the budget deficit and stabilized public debt levels.

Covid and Post-Pandemic Recovery (2020-)

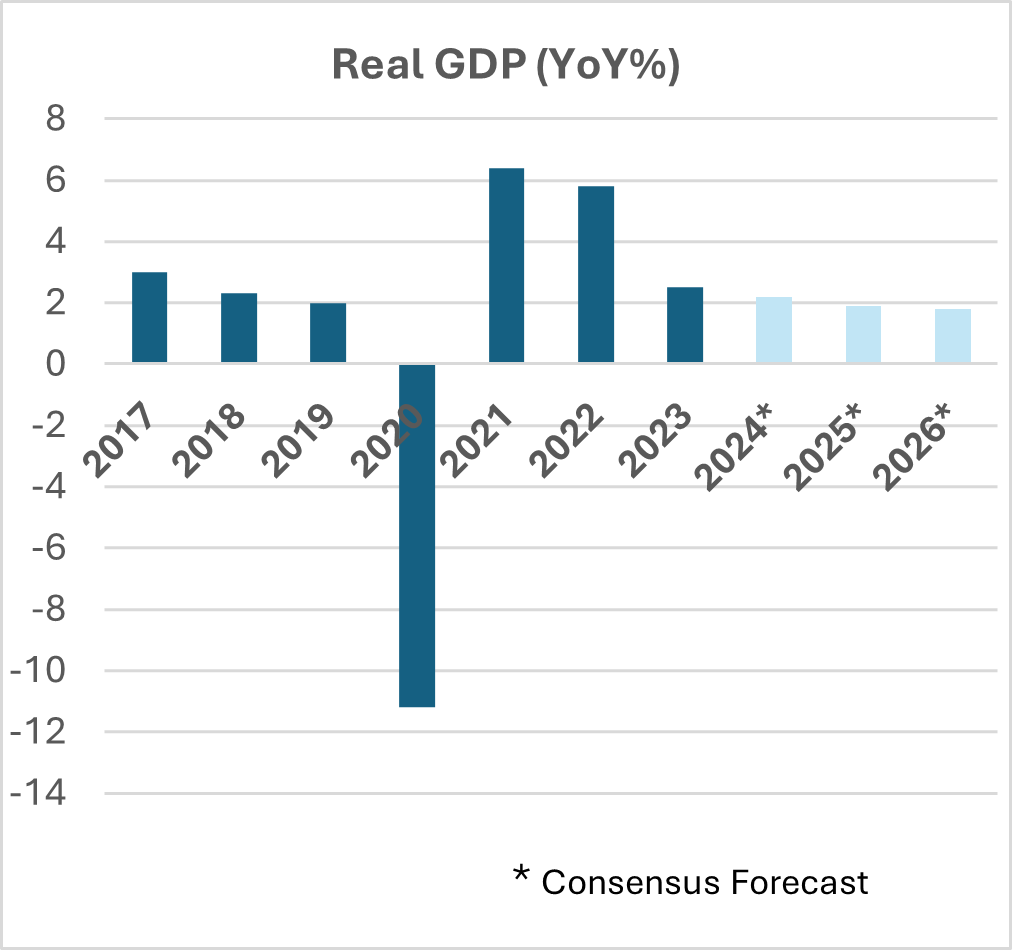

The COVID-19 pandemic caused a severe economic contraction in 2020, with GDP shrinking by 10.8%. Lockdowns and restrictions devastated the tourism and services sectors. The government implemented significant fiscal stimulus measures, including support for businesses and workers. The EU provided substantial financial support through the Next Generation EU recovery fund.

Economic recovery began in 2021, with GDP growing by 5.1%. Spain's economy continued to recover, with GDP growth projected at around 2.1% in 2023. Tourism rebounded strongly, contributing to economic growth. Spain faced inflationary pressures, exacerbated by global supply chain disruptions and energy price hikes. Inflation peaked at over 8% in 2022 but started to moderate in 2023. Public debt remains high, at around 113% of GDP in 2023. The budget deficit is gradually narrowing, expected to be around 4.5% of GDP in 2023.

Current Economic Overview

Spain boasts one of the most dynamic economies in the EU. Its GDP growth trajectory far surpassed the eurozone and EU averages, both stagnating at 0%. Retail sales in the Iberian nation soared by 1.9% year-on-year in February 2024, marking the 15th consecutive annual increase.

The country is experiencing positive momentum, outshining its European peers with robust growth figures, driven by healthy domestic consumption and a strong investment climate. Spain's GDP is projected to grow by around 1.9% in 2024, fueled by continued recovery in tourism, consumer spending, and investment. Structural reforms and EU recovery funds are expected to support medium-term growth.

The labour market remains strong, with the unemployment rate expected to decrease from 12.1% in 2023 to 11.6% in 2024, and further to 11.1% in 2025. Job creation is robust, driven by strong migration flows and the overall economic recovery. Spain witnessed one of the strongest increases in new employment in Europe during the fourth quarter of 2023, trailing only behind Romania (+1.5%) and Malta (+1.4%).

After reduction from the double-digit rates seen in 2022, inflation is expected to moderate further, reaching around 2.5-3% by the end of 2024 as energy and food prices stabilize and supply chain disruptions ease.

The government aims to reduce the deficit and debt levels through fiscal consolidation, phasing out energy-related measures, improving tax collection, and efficient public spending. The debt-to-GDP ratio is also expected to decline gradually. Spain's overall economic momentum prompted Moody's to revise the outlook on the Government of Spain to positive from stable in March, maintaining a rating of Baa1.

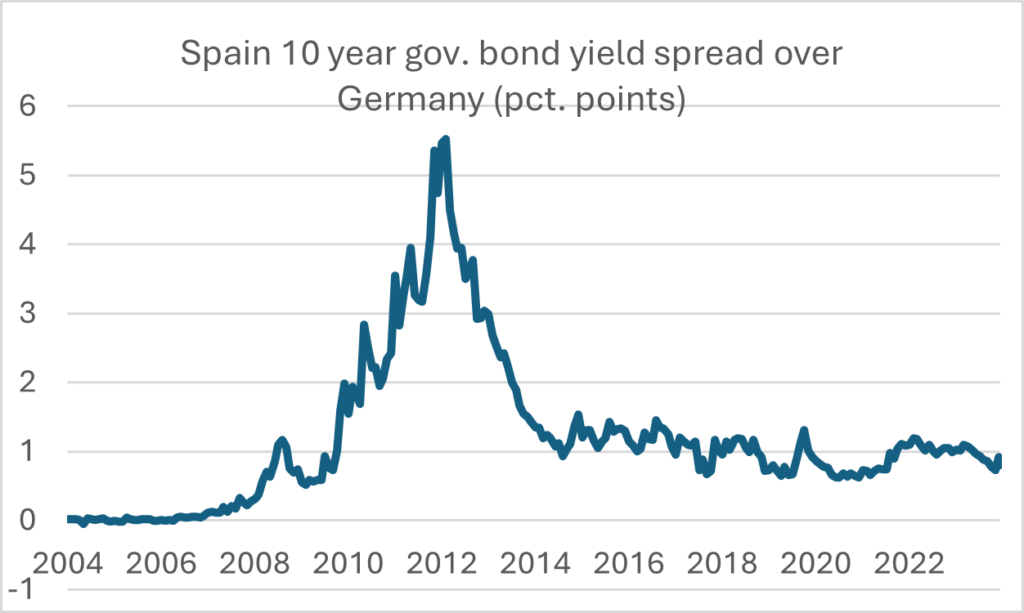

The rating agency highlighted Spain's low private sector leverage, strong banking sector, current account surplus, and improved labour market as key strengths. On the back of this development the spread between Spain's 10-year Bonos and German Bunds hovered around 85 basis points by the end of March, after touching lows unseen since February 2022 and dipping below its ten-year average.

EU recovery funds will play a significant role in financing investment in green and digital transitions. Spain is entitled to up to EUR 80 billion in EU grants, of which only half has been received so far. Ongoing structural reforms in the labour market, pension system, and business environment are essential for enhancing competitiveness and long-term growth. Investment in renewable energy and digital infrastructure is expected to boost productivity and sustainability.

Despite challenges from weaker economic conditions in key trading partners, Spain's external demand, particularly in tourism and non-tourism services, is expected to contribute positively to growth. In 1954, when Spain began promoting package holidays, there were only one million foreign tourists. Last year, there were 85 million, and the forecast for 2024 is up to 100 million. It is likely that Spain may soon overtake France as the world’s most visited country. Tourism now generates about 13% of GDP, and by some estimates, one in every four new jobs created in 2023 was in labour-intensive tourism.

Spanish companies are invested in fields like biotechnology, pharmaceuticals, renewable energy (with Iberdrola being the world's largest renewable energy operator), technology (such as Telefónica and Movistar), global corporations (like Inditex), petroleum companies (like Repsol), and infrastructure firms. Spain also has a solid banking system, including two global systemically important banks, Banco Santander and BBVA. The country has a large automotive industry with plants established by Volkswagen, Mercedes-Benz, Renault, and Stellantis. The IBEX 35 Index, comprising the 35 largest Spanish companies by market capitalisation, surged by approximately 11% in March, marking four consecutive weeks of gains and scaling heights not witnessed since May 2017.

Agriculture also significantly contributes to the economy. Agribusiness exports, slightly over EUR 40 billion, account for 3% of GDP and over 15% of total Spanish exports. Spain is one of the world’s major producers of meat, cereals, fruits and vegetables, olive oil, and wine.

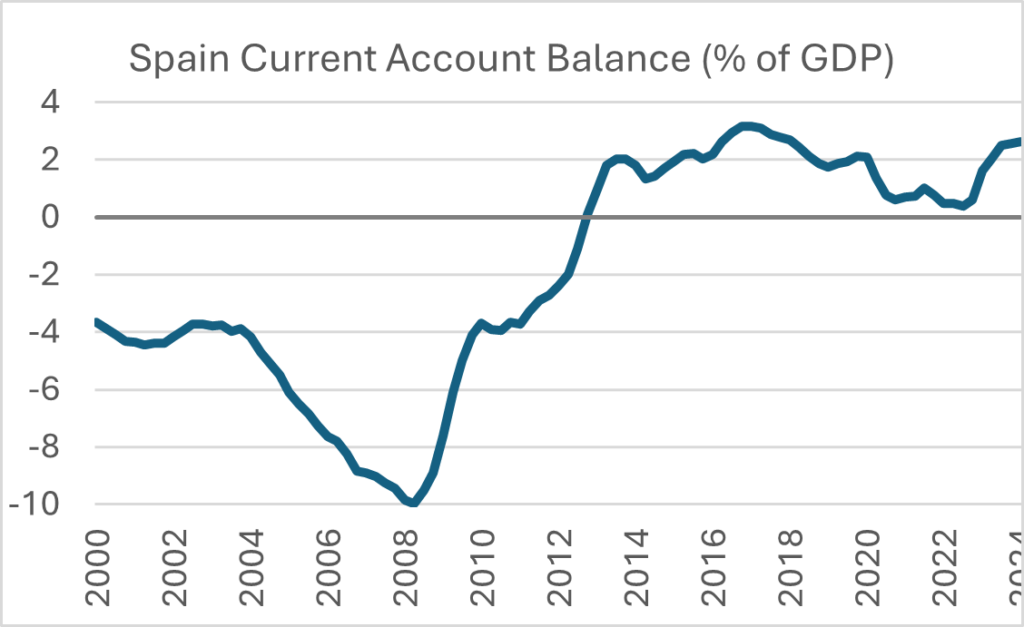

2023 was a great year for Spain’s foreign sector. With a current account surplus (compares a country's net trade in goods and services, plus net earnings, and net transfer payments to and from the rest of the world) of 2.5% of GDP, the strong performance of Spain’s foreign sector is particularly noteworthy when compared to the other large European economies. The Spanish economy has now accumulated 12 consecutive years with a current account surplus, surpassed only by Germany among Europe’s major economies.

Within Spain's services balance, both tourism and non-tourism services have performed very well. While tourism is the biggest contributor to the overall surplus, contributing a surplus of 3.9% of GDP up until Q3 2023 (3.7% in 2019), telecommunications, transportation and other services, including commercial services, have also made a positive contribution. In fact, 65% of the improvement in the balance of trade in services since 2019 is attributable to the improvement in non-tourism services.

One of the factors attracting foreign investments is Spain's infrastructure. In the Global Competitiveness Report, Spain consistently ranks in the top 10 globally for first-class infrastructure. The port of Valencia is the busiest seaport in the Mediterranean Sea and the fifth busiest in Europe. Spain has four other ports in the ranking of the top 100 busiest world seaports, tying with Japan in the third position globally. It is the fifth EU country with the best infrastructure, ahead of Japan and the United States. Spain is also a leader in high-speed rail, with the second-longest network in the world, only behind China.

Overall, Spain's economic outlook shows signs of steady growth, controlled inflation, and a declining unemployment rate, underpinned by strong domestic demand and investment. However, potential risks include uncertainties in global economic conditions and the impact of high interest rates on investment.

Spain's Demography

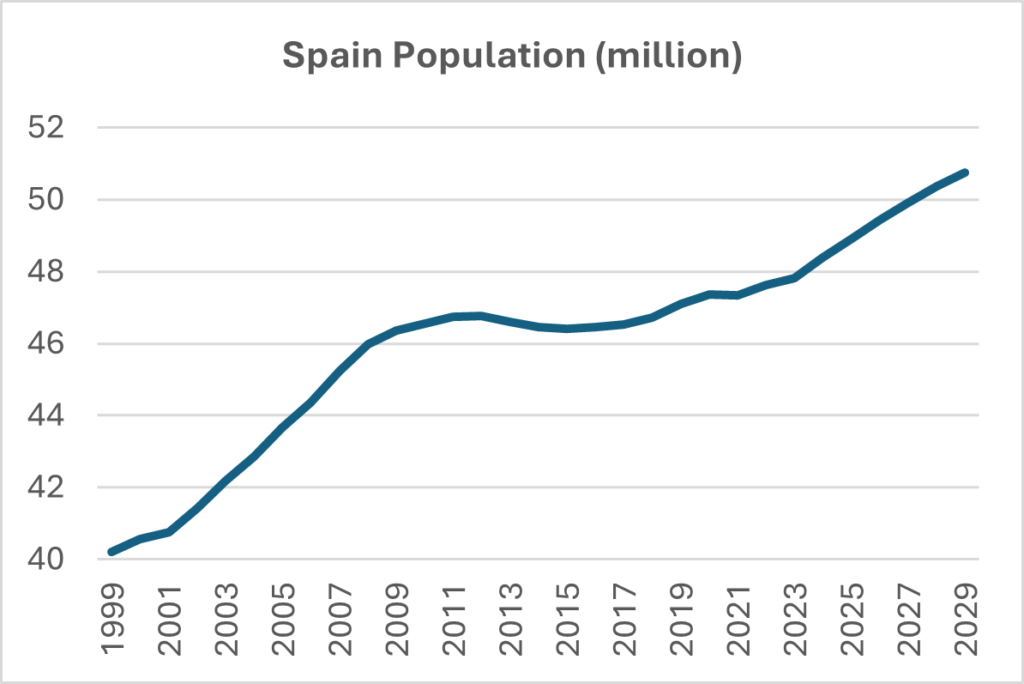

Demography is often overlooked, but nevertheless a crucial element of a country’s economic and development potential. As of 2023, Spain has a population of approximately 47.4 million people, making it the fifth most populous country in the EU. Spain's population growth has been relatively slow in recent years due to the negative natural growth rate. On the other hand, the country experienced robust immigration.

The country is a major destination for immigrants, particularly from Latin America, North Africa, and Eastern Europe. Immigrants contribute significantly to population growth. As of 2023, immigrants make up around 15% of the population, with the largest groups coming from Latin American countries and North Africa. One of the facts that reduce the negative impacts of immigration in comparison to other EU states is that a large part of immigrants come from Spanish speaking countries which are culturally, socially and religiously close to Spain. Additionally, Spain has one of the highest life expectancies in the world. As of 2023, life expectancy at birth is approximately 83 years.

Spain's demographic profile presents both opportunities and challenges, particularly in managing an aging population and youth employment and ensuring sustainable economic growth through effective immigration and labour market policies.

Housing Market

Housing prices in Spain have been on an upward trend since the recovery from the 2008 financial crisis and increased by 4-5% on an annual basis. Notably property price growth in Spain has stayed positive for consecutive 37 quarters. Low interest rates have made mortgages more affordable, encouraging home purchases. Continued urbanization has driven demand for housing in major cities. People moving from rural areas to cities for better job opportunities and quality of life has increased urban housing demand. Spain is also a popular destination for foreign buyers, especially from the UK, Germany, and other European countries. Foreign investment has been a significant driver of demand in the housing market, particularly in coastal and tourist areas. Golden visa schemes have also attracted non-EU buyers by offering residency permits in exchange for property investments. Moreover, the strong tourism sector has influenced the housing market, with high demand for holiday homes and short-term rental properties. The rise of platforms like Airbnb has increased the attractiveness of property investments in popular tourist destinations.

The post Covid inflation spike caused increasing interest rates globally. Despite this Spain’s market demonstrated high resilience. Demand overpowered supply, with the all-time high record of purchases by foreigners. Provinces like Alicante saw around 40% of properties sold to foreigners. In response to demand there has been a steady increase in construction activity. New housing developments are being undertaken, especially in urban areas and along the coast. However, construction levels are still below the pre-2008 boom levels, reflecting a more cautious approach by developers. In the Spanish market, around 600,000 homes are sold annually, and the number of new units has been falling steadily during recent years. In 2024 it is forecasted to be only around 60,000. Spain is one of the European countries that constructs the fewest homes per 1,000 inhabitants. Therefore, new housing will continue to be a scarce commodity, and even though sales will slow down due to mortgage accessibility, the market will not collapse due to the balance between supply and demand.

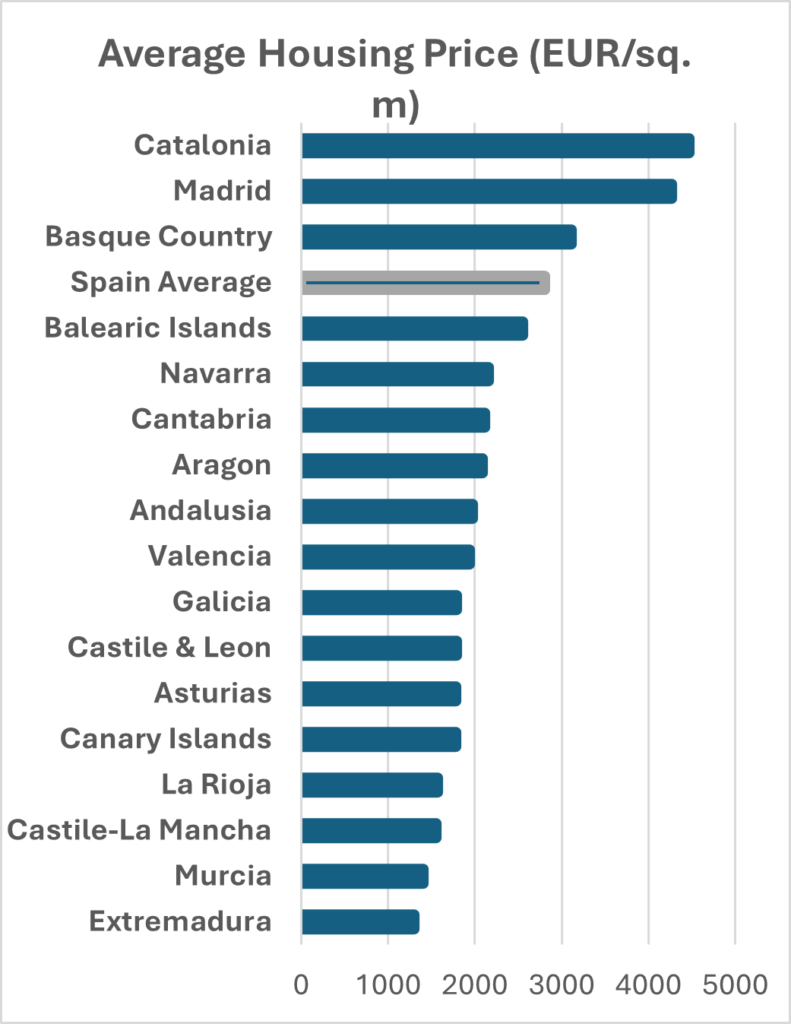

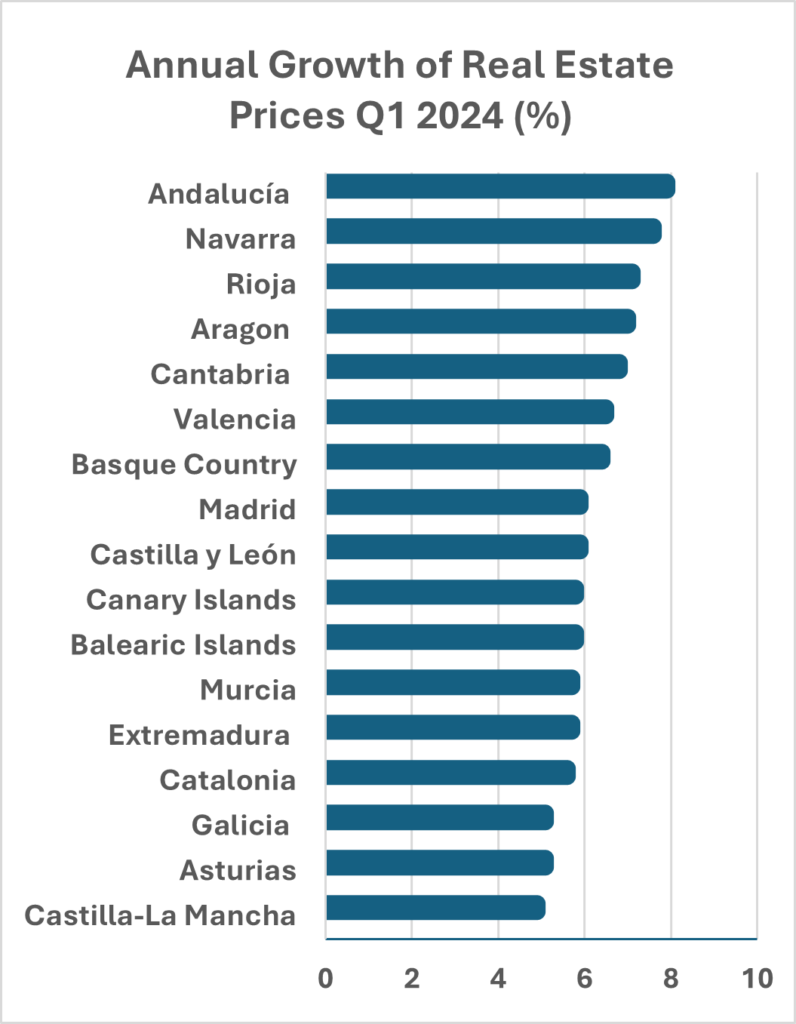

In 2023, property prices experienced an average increase of 7%. The upward trajectory is predicted to persist throughout 2024, proving the robust health of Spain's real estate market. Notably, property price growth in Spain has stayed positive for an impressive 37 consecutive quarters. By autonomous communities, Catalonia, the Community of Madrid, and the Basque Country lead with the highest prices. The Balearic Islands stand out as the region with the highest growth, reaching 6.8%, followed by Madrid with an annual increase of 6.3%.

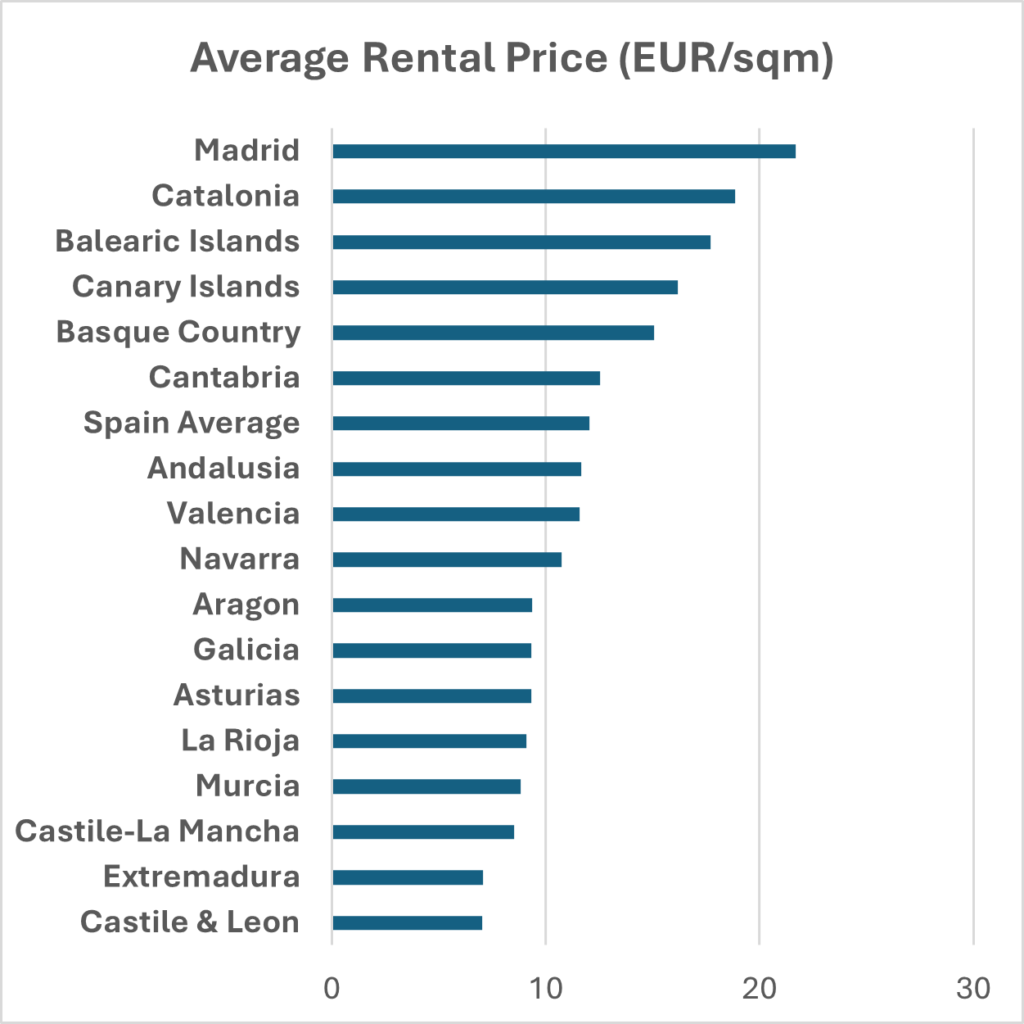

The rental property market in Spain is a significant part of the real estate market and it is undergoing significant changes due to the Housing Law introduced in May 2023. The law establishes a cap for all new lease agreements for properties located in strained zones. Despite the intent to decrease rental prices and increase rental properties' supply to help vulnerable families access the rental market, the resulting effect so far is opposite. The rental property supply fell by roughly 12% and continues to fall sharply in major markets. On the back of it rental prices soared by an average of 10% with cities like Valencia and Palma seeing increases by more than 20% Additionally, this law has led to a significant shift from permanent rentals to seasonal rentals, further hindering families' access to housing. Such counterproductive measures will only increase the deficit and therefore push the prices higher. Fadei (Federation of Associations of Real Estate Companies) predicts that rental prices will continue to rise in 2024 due to the lack of supply and "until a solution is found to address the concerns of small savers due to the implementation of the Housing Law."

Future Outlook

In the coming years several trends will support positive dynamics of the housing market:

• Pent up demand from buyers who were unable to secure mortgages due to high rates. With the ECB having already embarked on its rate cutting cycle this set of buyers will significantly increase demand, whereas supply will be slower to react.

• Spain's economic stability will serve as the backbone of its real estate market. Global economic conditions, GDP growth, and employment rates all contribute to buyer confidence and investment decisions.

• Technological advances greatly increased market transparency and liquidity. Virtual tours, augmented reality, and online platforms have transformed the buying and selling experience, making it not just efficient but globally accessible.

• Sustainability and energy-efficiency has become a major trend globally with government incentives and a strong focus by the developers.

• Spain's Golden Visa program and Digital Nomad Visa continue to attract wealthy and educated people to the real estate market.

Non-Performing Loan Market

The Non-Performing Loan (NPL) market in Spain has been an area of significant interest and activity, particularly following the financial crisis of 2008. In response, Spanish banks, with the help of the European Stability Mechanism (ESM), underwent significant restructuring, including the creation of the "bad bank" SAREB in 2012.

The Spanish NPL market has seen a decline in the overall volume of non-performing loans in recent years due to aggressive sales and improved economic conditions. Despite the decline, Spain still holds a significant volume of NPLs compared to other European markets, with a mix of residential, commercial, and unsecured loans.

Major Spanish banks like Banco Santander, BBVA, CaixaBank, and Banco Sabadell have been active in managing and offloading their NPL portfolios with numerous portfolio sales completed. This trend was caused mainly by The European Central Bank (ECB) and the Bank of Spain implementing stringent regulations to encourage banks to reduce their NPL exposures. International investors, including private equity firms and hedge funds, have been significant buyers of Spanish NPLs. Firms such as Blackstone, Cerberus, and Lone Star have been notable participants. Secondary market activity has also increased, with investors buying and selling NPL portfolios among themselves. Improved economic conditions and a more competitive market have led to better pricing for NPL portfolios. Prices can vary significantly based on the type of loan, collateral, and borrower profile.

The economic outlook will significantly impact the NPL market in future. Continued economic recovery will likely lead to further reductions in NPL volumes. Conversely, economic shocks or downturns could result in new waves of non-performing loans, potentially reinvigorating the market. Therefore, this market presents a unique opportunity for an investor to hedge against any negative developments in the EU financial markets and the economy in general. Additionally, innovations in loan servicing and management are likely to improve recovery rates and operational efficiency, making NPL investments more attractive.

This content is a marketing communication. It shall not be treated as investment advice, independent research or offer, recommendation or invitation to invest in the investment opportunities referred to herein. The content is not aimed at promoting services or products to persons based in jurisdictions where the distribution of said information would be illegal.

Investing in financial instruments involves risk, and there’s no guarantee that investors will get back invested capital. Moreover, past performance does not guarantee future returns. Indemo SIA shall not be responsible for any direct or indirect loss from using the provided information.